BitcoinIRA Fees: Top Things to Know in 2024

In this guide, we uncover BitcoinIRA fees and expose hidden costs and complex jargon. We’ll go over BitcoinIRA custodial, management, onboarding, trading, and security fees in 2024.

Swan Bitcoin IRA

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Get started in less than 2 minutes. Book a call with one of our Bitcoin IRA specialists today!

Schedule a CallBitcoin and crypto IRAs have become a big deal for millions of American’s planning for retirement.

So, which is best in 2024?

In this article, we uncover all the enigmatic fees of BitcoinIRA, including custodial, management, and account maintenance fees, along with onboarding, funding, transfers, trading, transaction, and security fees.

Short on time? You can jump to any section below!

Not all BitcoinIRA providers are created equal. BitcoinIRA has received flak for its sneaky fees, concealed in fine print and complex jargon.

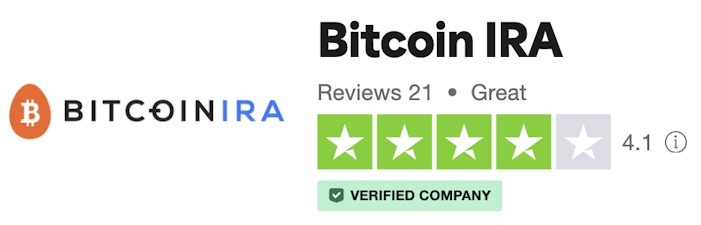

Founded in 2016

Customer rating on Trustpilot: 4.1 out of 5 stars (only 21 reviews) as of February 16th, 2024

4.5 out of 5 stars on the Apple App Store

4.4 out of 5 stars on the Google Play Store

Headquartered in Sherman Oaks, California

Assets: $2 billion of assets in custody

What People Like About It:

Ability to invest in various alternative cryptocurrencies all from one IRA account

Been in business since 2016

What People Dislike About It:

Hidden fees

The volatility and risk of various cryptocurrencies promoted

Regulatory uncertainty surrounding cryptocurrencies promoted

Limited investment options to Bitcoin and cryptocurrencies only vs. traditional IRAs

Market adoption and liquidity: Despite the growing popularity of cryptocurrencies, they are still relatively new and not widely accepted as mainstream investments

On November 15th, BitcoinIRA announced a strategic acquisition of Shrimpy.io.

Shrimpy.io. allows users to connect your exchanges and wallets to completely transform the way you invest in crypto.

Portfolio Rebalancing: Clients will be able to automate asset reallocation to consistently align their portfolio with their retirement objectives.

Dollar-Cost Averaging: Clients will get access to tried-and-true investment tactics, reimagined for the digital investment landscape.

Conditional Orders & Stop Loss Orders: Instill an extra layer of security to shield your investments from drastic market downturns.

Trade History Downloads & Advanced Reporting: Gain an unparalleled depth of insight into your investments with comprehensive analytics and transparent reporting.

In the following section, we will meticulously dissect the fees within the realm of BitcoinIRA, totaling an astonishing 8%, covering everything from account setup to trades and transactions, equipping you with the knowledge needed for informed decision-making.

Custodial, Management, and Account Fees — 1%

BitcoinIRA annually charges a custodial fee of 1.00% for the custody of clients' portfolios.

These fees are typically calculated as a percentage of the total value of the assets held in the IRA.

Investors should carefully consider these fees, as they can accumulate over time and significantly impact the overall returns and review the fee structure to understand how it may impact their long-term returns.

Setup Onboarding Fee — 0.99% to 4.99%

BitcoinIRA allows users to convert their existing IRAs into cryptocurrency IRAs. BitcoinIRA has a one-time service fee that it charges up front, ranging from 0.99% to 4.99%.

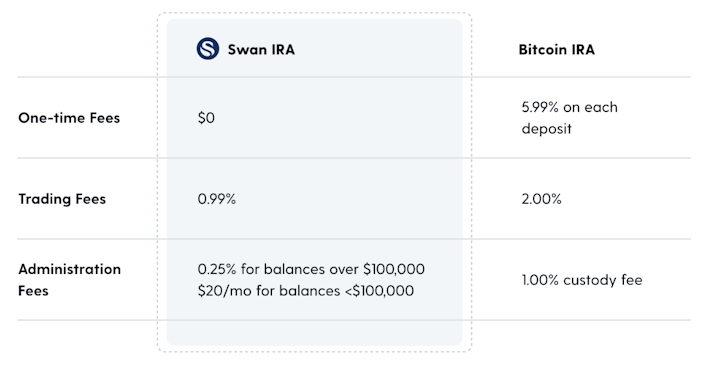

These fees are substantial, and among the highest of any BitcoinIRA provider. In contrast, Swan Bitcoin charges 0% to onboard and transfer funds.

Transaction Fee — 2%

BitcoinIRA charges a 2% transaction fee which is incurred when executing transactions within the BitcoinIRA platform.

This includes buying or selling Bitcoin or other cryptocurrencies, transferring funds, or conducting other transactions related to managing the IRA account.

It’s important for investors to be aware of these transaction fees as they can impact the overall cost and potential returns of their cryptocurrency investments within the Bitcoin IRA.

Security Fee — 0.8%

BitcoinIRA charges a 0.8% security fee.

These fees cover the costs of implementing robust security measures, employing encryption technologies, maintaining secure storage facilities.

The security fee helps provide peace of mind to investors by mitigating the risks of hacking, theft, or unauthorized access to their digital assets within the BitcoinIRA platform.

When it comes to fees, BitcoinIRA leaves much to be desired in terms of transparency.

They make it difficult for investors to get a clear picture of their fee structure, forcing them to reach out to representatives for more information.

This approach can be bothersome since many other Bitcoin IRA providers like Swan Bitcoin readily provide comprehensive fee information online.

Despite branding itself as a Bitcoin IRA company, BitcoinIRA promotes +60 cryptocurrencies and alternative assets within its crypto IRA platform.

In these legal actions, the SEC has explicitly identified around 67 alternative cryptocurrencies that it considers unregistered securities. Interestingly, many of these tokens are included in BitcoinIRA’s product offerings.

This alignment of the SEC’s concerns with BitcoinIRA’s portfolio raises further questions about the company’s compliance with regulatory requirements and the potential risks investors face.

While a 5.99% fee might not seem like much to the casual investor, the difference is extraordinary over a decade and multi-decade periods.

BitcoinIRA: 5.99% per deposit fee

Swan Bitcoin IRA: No deposit fee

If I deposit $6,000 annually into BitcoinIRA’s product, instead of Swan, what is the % difference over twenty years from deposit fees alone?

Bitcoin IRA

Fee Per Deposit = $6,000 × 5.99% = $359.40

Number of Deposits Over 20 Years = 20 deposits (assuming one deposit per year)

Total Fees Paid for BitcoinIRA = $59.90 / deposit × 20 deposits = $7,188

No deposit fee, so the total fee paid for Swan Bitcoin is $0…

Total fees for Swan Bitcoin) / Total fees for BitcoinIRA) × 100

Percentage difference = ($7,188 — $0) / $7,188) × 100

Percentage Difference: ≈100%

Dollar Difference: $7,188

In a nutshell, BitcoinIRA’s fee structure is a cause for concern, primarily due to its startling lack of transparency and exorbitant fees that can reach as high as 8%.

This combination of hidden costs and sky-high fees can significantly impact an investor’s returns and hinder their ability to achieve their financial goals.

It’s imperative for individuals to carefully evaluate and compare fee structures among different IRA providers to ensure they are making informed decisions and maximizing the potential of their investments.

In contrast, Swan prioritizes transparency, offering clear and comprehensive fee breakdowns upfront.

By choosing a provider that values transparency and provides a clear understanding of costs, investors can make more informed decisions and have greater confidence in their Bitcoin IRA investments.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?