Exploding Three Myths About the Upcoming Bitcoin Halving

The next Bitcoin halving is almost here. We explore whether the halving is priced in, if other coins are a model for Bitcoin, and fear of a mining death spiral.

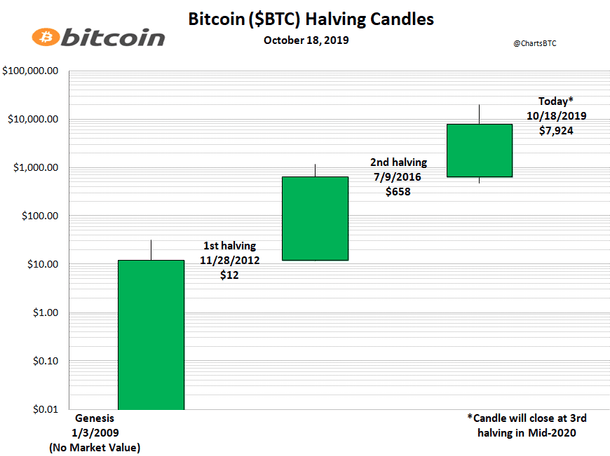

The next Bitcoin halving (aka halvening) is almost here. In May 2020, the reward for mining new blocks will be cut in half from 12.5 to 6.25 Bitcoins.

A halving occurs after every 210,000 blocks (approximately every four years) until all 21 million Bitcoins have been released by roughly the year 2140. As the supply of newly released coins dwindles, the price of Bitcoins could rise if demand remains consistent.

There are a lot of misconceptions around halvings.

Let’s explore a few of them…

Some believe that because Bitcoin’s stock-to-flow model is already known, the halving is already priced in correctly (i.e., already reflected in Bitcoin’s price). Joe Weisenthal, the editor at Bloomberg, noted: “You can’t simultaneously believe that markets are smart/efficient and also believe that events literally everyone can see coming at the same time actually matter.”

Meltem Demirors of CoinShares, a cryptocurrency investment/research firm, argued that due to the rise of Bitcoin and cryptocurrency derivatives, which decouples these assets from their inherent value and supply-demand economics, “there is a very real possibility the price of Bitcoin does not go up after halving.”

Halvings have indeed been known since the inception of Bitcoin. If this halving is priced in, that would imply that past halving should have also been priced in. Yet in the past two halvings, the price skyrocketed in the two years following.

The halving impacts the future supply of Bitcoin. Since 95 — 99% of people worldwide are not in Bitcoin markets and will be entering after the halving, the future will bring more demand to an inflexible supply. When a supply shock like the halving occurs, one can’t predict where demand will meet the new-found supply.

It’s also worth mentioning that many people who currently own Bitcoin, perhaps even the majority, do not know about the halving. A check of Google trends shows “Bitcoin halving” on the rise. The knowledge of the halving is still growing.

With each halving, comes even higher price expectations among big industry players and institutions.

Pseudonymous Bitcoin analyst Plan B, the author of the stock-to-flow model, argues that while markets price in all information, they sometimes misprice risk. He points out that assets generally have returns correlated to their risks, but Bitcoin appears to be literally “off the charts” on its risk-to-reward ratio. He says, “It seems that these risks have been overestimated by the market, and that bitcoin really was a great investment opportunity, in line with [stock-to-flow] model.”

Some believe that since other coins dumped after their halvings, the same will happen with Bitcoin. They point to the example of LTC (Litecoin): “Hype Over Litecoin’s Halving Leaves Owners Holding the Bag.”

This belief ignores the other fundamental issues that plague altcoins like LTC. Bitcoin’s trading volume is typically more than the next 30 largest altcoins by market capitalization combined. The smaller the market, the easier it is to manipulate. Traders use altcoin trading to accumulate more Bitcoin, while Bitcoin itself is used as a store of value and not often moved. People plan to pass Bitcoin on to their children. At the same time, it’s hard to find anyone who seriously considers this for any other altcoin. This makes sense, as only the coin with the highest liquidity and saleability across time and space can be considered a monetary good; this is a self-reinforcing characteristic.

Other coins are neither scarce nor secure, like Bitcoin. It is perhaps for this reason that gold and Bitcoin have strong price correlations with their stock-to-flow models, and other altcoins do not, indicating that we should not use altcoin behavior to predict Bitcoin behavior.

Block rewards are granted to Bitcoin miners for performing the work of securing the Bitcoin ledger. The halving is a reduction in mining rewards. If miners no longer receive as many block rewards, will they continue mining, or will they sell what they have and leave the market, driving prices and hash rate (calculations per second performed by miners and adding to the security of the network) lower, and creating a “mining death spiral”?

Ramak J Sedigh, founder and CEO of Plouton Mining, says, “The upcoming halving will force the small operators and those running S9s out of the market, except in the unlikely scenario that BTC reaches a new all-time high by the end of May.”

Jeffrey Barroga, Digital Marketing Officer at peer-to-peer Bitcoin marketplace Paxful, says, “Mining is already competitive and resource-extensive as it is, and when you combine that with the impending block reward reduction in May, hobbyist miners, and small players might find that whatever BTC they gain is insufficient to pay for the overhead costs of running their rigs.”

Bitcoin has a built-in Difficulty Adjustment Algorithm. The mining process is similar to throwing darts and trying to hit a bullseye of a particular size. As the price of Bitcoin goes up, more miners want to participate. To regulate how much Bitcoin is issued at any one time, the bullseye shrinks to make it harder to hit. The same thing happens in reverse if the price of Bitcoin falls or miners stop mining for any other reason. The bullseye grows in size, making it easier and more profitable to participate in mining.

Fears of miners abandoning the network due to halvings are as old as Bitcoin itself, dating as far back as forum posts in 2011. About a year ago, Finance Magnates wrote an article spreading a lot of fear about a mining death spiral, which appeared to confuse GPU-based cryptocurrency mining with Bitcoin mining, among other things. Nonetheless, in the period that followed, Bitcoin massively added hash rate rather than losing it.

While it’s true that without a rise in Bitcoin prices, the halving may make some miners unprofitable, it’s important to realize that all miners have a different base cost depending on their electricity and other operating expenses. If the price of Bitcoin does not rise, the most inefficient miners will be forced off the network, and more efficient miners will take their place.

Rather than following the predictions of journalists, it may be worth following the money. The industry has placed long-term bets on Bitcoin’s future, ranging from the Peter Thiel-backed Layer 1, which is funded with $50M and will open on 30 acres in Texas, to the Whinstone project, which plans a giant 1GW mine in the same area. All over the world, in places like Mongolia and Paraguay, reports of mining are on the rise as people find new and creative ways to tap previously unharnessed energy sources.

When it comes to the halving, there are plenty of misconceptions floating around. Make sure to examine all aspects of it and come to your own conclusions.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Yan Pritzker is the co-founder and CTO of Swan Bitcoin, the best place to buy Bitcoin with easy recurring purchases straight from your bank account. Yan is also the author of Inventing Bitcoin, a quick guide to why Bitcoin was invented and how it works.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?