Best Bitcoin Wallets Review: 2024 What to Know

Not Your Keys, Not Your Bitcoin!

Alright, so you’ve acquired some Bitcoin. Now, what’s the best way to store it in 2024?

TL; DR: Not your keys. Not your coins.

If you leave Bitcoin on an exchange, it’s legally not your Bitcoin. At any time, the exchange can freeze your account, disable withdrawal ability, or take several actions that mean you can’t get access to your Bitcoin, like what we recently saw with FTX, Genesis, GBTC, BlockFi, and other third-party wallet services.

We are here to help take you through the process of finding the right Bitcoin wallet for you.

Although it seems like a straightforward question, there is a surprising amount of nuance to consider.

How much Bitcoin do you have?

How often do you plan to spend it?

Are you confident your keys are more secure with you than with a regulated custodian’s cold storage?

Let’s get into it!

Bitcoin is a bearer asset, meaning you can hold the keys to your Bitcoin yourself. When you maintain your own Bitcoin keys, you are in direct control of your money. It is not entrusted to any third party, like a bank.

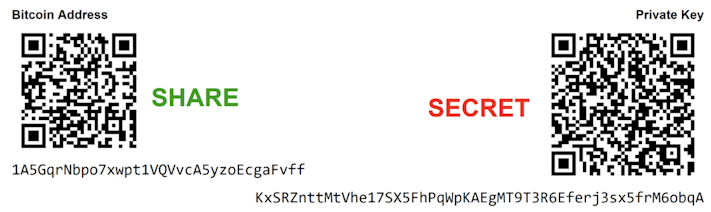

In cryptography, a public key is used to encrypt messages, and a private key is used to decrypt them. If someone wanted to send you an encrypted message, they would encrypt it with your public key.

Your private key is the only way to decrypt that message, so as long as you are the only person who holds the private key, you are the only person who can read the message.

Bitcoin uses public/private key cryptography to secure transactions. A private key is created when you make a Bitcoin wallet. The wallet creates public keys that are hashed and used as addresses for receiving Bitcoin.

The private key is required to prove the ownership of the Bitcoin stored at that address so it can be spent.

If you personally don’t control the private keys associated with your Bitcoin, then you don’t actually hold your own Bitcoin. In other words, if an exchange or a bank is holding your Bitcoin on your behalf, you are not in direct control of your Bitcoin. You are outsourcing the security of your Bitcoin to another party.

You should hold your own keys once you determine that the risk of holding your keys personally is lower than the risk of a custodian losing them. Making this decision relies primarily on your understanding and comfort level of how and why to hold your own Bitcoin keys.

It’s empowering to be able to hold your Bitcoin in your custody so that it cannot be seized or confiscated by banks or the hackers that target them.

Our goal is to help you become comfortable with the prospect of holding your own keys. Until then, the Bitcoin in your Swan wallet is held by our U.S. custodial legal trust banking partners in an account in your name as the beneficial owner under state-of-the-art security practices.

Now, let’s look at your options for taking control of your own Bitcoin keys.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

The main tradeoff to consider when storing your Bitcoin is between security and convenience. Obviously, both security and convenience are desirable traits when storing your Bitcoin; however, they are directly opposed to each other.

Where do you sit on the security vs. convenience spectrum?

Ask yourself these questions to gain a better feel for what storage method makes the most sense for you:

Total Value — Are you storing on the order of 0.1%, 1%, or 10+% of your net worth in Bitcoin? The answer would necessitate very different methods of storing your Bitcoin. Obviously, you would be willing to suffer more inconvenience if it meant protecting 50% of your net worth.

Timeframe/Accessibility — When and how often do you need to spend your Bitcoin? Is this more of a checking account, a medium-term savings account, or is your Bitcoin more similar to a long-term retirement account?

Pro Tip: Don’t make your custody setup so complicated that even you forget how to access the funds. Bitcoiners tell cautionary tales of people losing Bitcoin due to overcomplicated custody setups resulting in the owner forgetting how to access their coins.

Now that you’ve decided to acquire some Bitcoin (smart move), it’s time to choose where to store your Bitcoin. This can feel overwhelming when you’re getting started.

Mobile Bitcoin Wallets

What: Users store private keys on a mobile device.

Pros: Simple to use, suitable for beginners, works for small amounts, convenient for spending even though most people rarely spend their Bitcoin right now (too much upside to holding for the long term!)

Cons: Least secure option as private keys are on a device connected to the internet. If an attacker gains physical access to your phone, funds can be sent to their own wallets. Not suitable for long-term storage.

Example: Muun.

Desktop Bitcoin Wallets

What: Users store private keys on their desktop computer.

Pros: Good UX, convenient for spending. Most desktop Bitcoin wallets allow users to connect to signing devices for enhanced security.

Cons: Not very secure as computers are connected to the internet and vulnerable to attacks. Not suitable for long-term storage.

Examples: Bitcoin Core and Electrum (advanced), Specter (intermediate), Blockstream Green (beginner).

Hardware Bitcoin Wallets

What: Users store private keys on a purpose-built piece of hardware called a signing device. These devices can connect with Bitcoin software running on desktop and mobile devices.

Pros: Private keys never touch the internet, which reduces the risk of online attacks. Suitable for long-term storage. Since most signing devices require a PIN to access, if you lose your signing device, you can use the recovery phrase to regain access to your Bitcoin.

Cons: Users must secure a recovery phrase which serves as a backup to their hardware, and requires a thoughtful strategy to protect.

If your hardware wallet is stolen, your funds are at risk of being hacked.

Note: Protecting recovery phrase backups is standard practice for self custody of Bitcoin.

Examples: Blockstream Jade, and Coldcard.

What: A paper Bitcoin wallet is a way to store Bitcoin private keys offline. It typically involves printing out your Bitcoin public and private keys on paper oftentimes encoded as a QR code.

Pros: If properly generated are immune to online hacking risks.

Cons: Vulnerable to physical damage and degradation, inconvenient for frequent use, and pose a high risk of irreversible loss if lost or stolen. Carry a risk of key interception during printing if the printer is not secure.

Multi-sig Bitcoin Wallets

What: User stores private keys in a unique wallet that requires multiple private keys to sign before your funds can be moved. A “2‑of‑3” multi-sig wallet, a user needs two out of three private keys to move funds.

Pros: One of the most secure ways to store your Bitcoin, reduces the effectiveness of physical attacks and is suitable for long-term storage.

Cons: Hard to set up on and manage on your own, but several services exist to make it easier. Not convenient for spending, but that’s the point.

Examples: Swan Vault, Unchained Capital’s Vault (2‑of‑3), Specter (DIY), Electrum (DIY).

Hot wallets are connected to the internet.

This means your keys are easier to access than they are on a hardware wallet, but this also means your funds are more vulnerable to hackers. Hot wallets are ONLY recommended for small amounts.

Cold wallets are NOT connected to the internet. This means your funds are harder to access. Cold wallets are less convenient for users but much more challenging for hackers to access your funds.

Cold wallets should be considered the only option for long-term storage.

Most wallets require users to write down a “backup seed phrase.”

This is a safety precaution in case you lose access to your private keys/wallet. This also means users must be very cautious with their backups as they contain all the necessary information to access your funds.

Treat your backups as securely as you would a pile of gold.

Seedless Bitcoin Wallets

Another way to store your Bitcoin is with a seedless wallet. These are designed for multi-signature accounts where users don’t create backup seeds and instead rely on a service for backups.

Instead of requiring a single private key signature to move your funds, multi-sig wallets require multiple signatures to move your funds. There are many ways to architect a multi-sig wallet, but let’s use a 2‑of‑3 for our example.

As a user, this means you have three total private keys corresponding to a single Bitcoin wallet. To move your funds, you need at least two of your private keys to sign a transaction.

Most users will physically separate the locations of each key to further minimize risks.

*** Just don’t get too creative, or you might fool yourself and lose your funds (it’s happened many times).

As mentioned above, here are a few examples of multi-signature wallets:

Swan Vault (2-of-3)

Blocksteam Green Wallet (2‑of‑2)

Casa’s Keymaster (2‑of‑3 and 3‑of‑5)

Unchained Capital’s Vault (2‑of‑3)

Specter (Design your own setup)

Benefits of Multi-sig

Multi-sig offers some room for error. If you have only a single private key and lose it, your funds are lost forever. However, if you have a 2‑of‑3 setup, you can afford to lose one private key and still access your funds.

Multi-sig also mitigates physical attacks. Let’s say you were physically threatened and asked to give up your precious Bitcoin. If you had a standard wallet (not multi-sig), you could quickly transfer your Bitcoin to the attacker.

If you had a multi-sig setup, with one of your keys at your house and the other keys in a separate location (Ex: your office and a safety deposit box).

This geographic separation of keys significantly reduces the incentive for a physical attacker to target your Bitcoin.

Why Does My Bitcoin Wallet Address Keep Changing?

Each set of private keys is capable of generating billions of public keys. These public keys are then transformed (through a mathematical process called hashing) to produce public addresses.

Every single one of those addresses can receive Bitcoin. So each set of private keys you own can produce its own unique, massive set of public addresses that you, and you alone, own.

Anyone can send Bitcoin to those public addresses. Still, only the holder of the private keys can spend Bitcoin from those addresses.

An easy way to think of Bitcoin wallet keys is thinking of them like your email!

Many people like to analogize private keys, public addresses, and Bitcoin wallets to email addresses. The private keys are your password, the public address is your email address, and the wallet is your email client (Gmail, Protonmail, Yahoo, etc.).

Although useful, this analogy is slightly misleading because, with Bitcoin, each password (private key) you own gives you access to billions of potential email addresses (public addresses) to send Bitcoin from and receive Bitcoin to.

Don’t be concerned if your wallet consistently generates new Bitcoin addresses. That’s actually one of its features! Wallets generating and using new public addresses help protect your privacy from people snooping on the public Bitcoin blockchain.

Just remember that so long as you still hold the private keys to your wallet, you alone are still on the present and future Bitcoin sent to any public address that your wallet generated.

Make sure to keep your Bitcoin private keys safe, secure, and private.

The easiest way to approach Bitcoin custody is to focus on “How much money is at stake?”

In other words, what percentage of your net worth is being secured. We understand each person’s situation is unique. Below are our recommendations.

Use this as a guideline rather than absolute truth.

Small Amounts (~0.1% Net Worth) — Use a Mobile Bitcoin Wallet

Muun — It’s probably the easiest Bitcoin wallet for iPhone and Android. Muun is a hybrid Bitcoin and Lightning Network wallet known for its simplicity, security, and seamless handling of both on-chain and off-chain transactions.

It features an intuitive design and robust security measures, including an encrypted “Emergency Kit” for fund recovery. It uses “Submarine Swaps” for easy transfers between networks.

Muun simplifies the user experience by eliminating the need for manual channel management and is partially open-source for increased transparency. It’s designed for users at all levels.

Phoenix — A user-friendly Bitcoin wallet focusing on the Lightning Network for quick, low-cost transactions. It’s non-custodial, offering full control over funds, automates technical tasks for ease of use, and features robust security measures.

It automates complex processes like channel management, making it accessible to newcomers while ensuring users retain full control over their funds through private keys.

Phoenix also features security measures like PIN and biometric authentication, supports easy backup and restoration, and is open source for transparency and community review.

Medium Amounts (~1% Net Worth) — Use a Hardware Bitcoin Wallet

Blockstream Jade — A secure and affordable hardware wallet designed for Bitcoin and Liquid Network assets.

The wallet supports USB and Bluetooth connectivity, is compatible with the Blockstream Green software wallet, and features open-source firmware for enhanced security through community review.

Jade is user-friendly, with a clear display and physical confirmation button, and supports multi-sig transactions for added security.

Passport — A hardware wallet focused on high security, ease of use, and durability.

It stores private keys offline, utilizes open-source firmware for community-driven security enhancements, and supports air-gapped operations via QR codes, eliminating the need for physical connections.

Passport features a user-friendly interface designed to resemble a passport for ease of carrying and durability.

It supports multi-signature transactions for added security layers and is compatible with various Bitcoin wallet software.

SeedSigner — A DIY, open-source Bitcoin hardware wallet that allows users to assemble their device from widely available components, such as a Raspberry Pi Zero.

It prioritizes security by enabling offline storage and signing of transactions, enhancing user privacy and sovereignty over their funds.

The wallet is designed for affordability, making it a cost-effective alternative to traditional hardware wallets.

Its compatibility with various Bitcoin wallet software that accommodates PSBTs, offering flexibility to users.

However, it requires more user involvement in setup and operation. Its not an ideal choice for beginner’s.

Coldcard — A Bitcoin-only hardware wallet known for its robust security features and support for air-gapped operation. Coldcard is an advanced wallet we only recommend for advanced Bitcoiner’s.

Key features include a secure element for private key protection, open-source firmware and hardware, PIN code protection with a duress PIN option, and physical security measures like tamper-evident packaging.

It offers a simple user interface, microSD card support for transaction signing, and compatibility with popular Bitcoin wallet software.

Advanced features include multi-sig support and Partially Signed Bitcoin Transactions (PSBT) for enhanced security.

Large Amounts (More Than 10%+ Net Worth) — Use a Multi-sig Bitcoin Wallet

Swan Vault — A comprehensive Bitcoin custody platform that offers secure self-custody with a very user-friendly experience.

Features collaborative multi-signature security, requiring two of three keys to move Bitcoin, with two held by the user and one by Swan for recovery purposes.

Designed for Blockstream Jade hardware wallets, it offers easy onboarding, expert security backed by regular audits, and integration with the Swan ecosystem.

Advanced users can enjoy full sovereignty with multi-sig wallet recovery into Bitcoin Core via Specter Wallet.

Provides inheritance planning for Swan Private clients.

That’s our summary of the 2024 Bitcoin self-custody landscape to date. The old adage rings true: “Not your keys, not your coins.”

We understand self-custody can seem intimidating at first. Swan Vault aims to make it more convenient and accessible for everyone. Vault combines 2-of-3 multi-sig security with an intuitive interface.

This removes the technical hurdles that often discourages beginners. Users also receive dedicated guidance from Swan team of experts. Together, the simplified platform and helpful support empower users who still retain sole authority over their funds.

Sign up now to get on the list for early access to Swan Custody. We’re here to help; reach out with any questions.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Brandon is an entrepreneur, writer, speaker, and passionate Bitcoiner. His articles have been read by more than 2 million people online. Most well known for exploring the parallels between bitcoin and mycelium.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?