Are “Ordinals” Worth Worrying About?

Ordinals and Inscriptions are not ideal for monetary users of Bitcoin, but they are not currently a systemic issue for Bitcoin. Learn why with Stephan Livera!

Swan Private Insight Update #31

This report was originally sent to Swan Private clients on January 15th, 2024. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

As users go to transact using Bitcoin on-chain today, they may be surprised to see that fees to “hit the chain” have gone up dramatically. But why? Where are the stampeding hordes of newcoiners stacking sats into their Coldcard? They do exist, but there is also a new class of Bitcoin on-chain users: those partaking in Ordinals and Inscriptions. This new craze has ignited a new round of community debate, but it has also been a boon to Bitcoin miners all around the world because of greater on-chain fees. But are these ‘ordinals’ worth worrying about, and can they be stopped or filtered? Or, is it best to leave them and instead ‘bite the bullet, ’ with the expectation that monetary transactions will eventually outcompete Ordinals/Inscriptions uses? Let’s explore:

Firstly, what are ordinals?

Quoting the Ordinal Theory FAQ:

“Ordinal theory is a protocol for assigning serial numbers to satoshis, the smallest subdivision of a Bitcoin, and tracking those Bitcoins as they are spent by transactions.”

So, in other words, it is a made-up ‘lens’ or overlay that some people can apply to Bitcoin’s transaction ledger. And in doing so, they come up with an arbitrary way of ‘tracking’ satoshis as they move from transaction inputs to outputs. Think of Bitcoin outputs as ‘coins’; you use outputs from a previous transaction as inputs for the next one. When Bitcoin transactions occur, the inputs are consumed/destroyed. So the ‘ordinals lens’ specifies a way that the satoshis hypothetically move from inputs to outputs. People who use the ord software are using this lens to ‘track’ the satoshis, independently of the people simply using Bitcoin without any care or interest in the ordinals protocol.

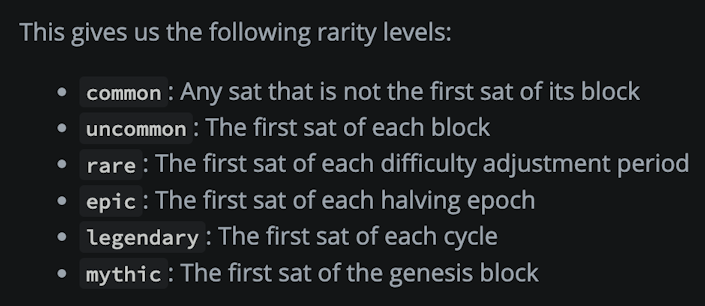

There are different levels of rarity for satoshis under ordinal theory, which can be seen from the table below:

docs.ordinals.com

So now there are ordinals and people who ‘collect’ these rare types of satoshis. Given the different ways ordinals and ‘rare satoshis’ have to be managed, there are now specialized wallets, exchanges, and front ends available for these users.

Now, this overall ordinals method is essentially made up, as Casey Rodarmor admitted on my podcast in Episode 456. Even though it is arbitrary, there seems to be a committed audience of people who adopt this view. While Ordinals became popular in early 2023, they are not a new idea and, in fact, originated in 2012, as Giacomo Zucco explains in his talk here. What’s old is new again!

“Ordinals” has become somewhat of an umbrella term. So, let’s walk through some of the other pieces here:

Inscriptions — these are Bitcoin-native digital artifacts written to Bitcoin’s blockchain in a taproot script. They are otherwise commonly known as “NFTs” or Non-Fungible Tokens. Commonly, they are JPEG image files, but they can take other formats too. These inscriptions leverage the above ‘ordinals’ protocol in how satoshis are tracked across transactions, which allows these inscriptions to be transferred, bought, sold, etc. Inscriptions are done in two phases, a ‘commit’ and ‘reveal’. The inscription is contained in the input of a reveal transaction, and the inscription is deemed to be made on the first sat of its input. Inscriptions do exist on altcoin chains also. But given Bitcoin’s special properties of decentralization, immutability, and longevity, Bitcoin inscriptions have become very popular. Some of the enthusiasts particularly like that it is on-chain and not merely ‘pointed to’ like in some altcoin NFT schemes. As they make use of Taproot transactions, inscriptions also receive the ‘Segwit discount, ’ which makes them cheaper to inscribe on the chain.

BRC-20 — This is an experimental standard from March 2023 for creating fungible tokens using a text inscription using JSON (JavaScript Object Notation) data. The name BRC-20 is a play on ERC-20 from the Ethereum world. There are three actions possible: these BRC-20 tokens can be deployed, minted, or transferred. There are many users who are attempting to ‘mint’ BRC-20 tokens for themselves. Generally, they consider themselves ‘collectors, ’ or in many cases, they are minting in the hope of being able to dump the token later on to somebody else. There are various ‘Ordinals-aware’ wallets, front-ends, and exchanges that help users manage and transfer their ordinals, inscriptions, BRC-20 assets, etc.

Stamps (aka SRC-20) — This is another protocol to ‘inscribe’ images into Bitcoin. However, these are stored in UTXOs in Bitcoin’s chain, and these cannot be pruned like ‘regular’ Ordinal inscriptions can. These Stamps do not receive the Segwit discount that inscriptions do (thus, they cost more) but offer more flexibility in minting larger quantities than Ordinal Inscriptions. Stamps are more pollutive for Bitcoin’s network, as the UTXOs cannot be pruned, and it raises the requirement to be able to run a Bitcoin node.

What’s the impact of these ordinals and inscriptions?

“Regular” Ordinal Inscriptions can be pruned out from the Bitcoin blockchain, as they are stored only in the witness data. So, as an example, you could set up a full node that has downloaded and verified the full Bitcoin blockchain, and if you didn’t want to store the ordinal inscription images and data, you could prune your node down to free up storage space. In this case, you would still be running a full node but not maintain the archival status of containing all Bitcoin blockchain data. Of course, in order to remain synced with the Bitcoin network, you must still download and process blocks, which can contain new inscriptions.

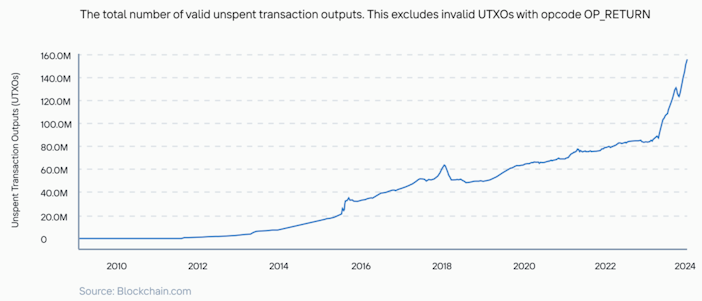

Stamps and BRC-20 do increase the UTXO set, and given there is not a cost charged by the protocol for the net creation of UTXOs, this is arguably spam. The UTXO set expansion shown in the chart below shows how the UTXO count was previously around ~80M as of early 2023 and has now blown up to ~156M UTXOs as of January 2024.

Blockchain.com

The Stamps (SRC-20) protocol was published in March 2023, and the BRC-20 standard was also created in March 2023. This aligns pretty well with the blow-up in UTXO count. Though this is not ideal for keeping Bitcoin nodes cheap and easy to run, it is not a systemic issue for Bitcoin at this stage.

Is there an impact at the transaction fee level?

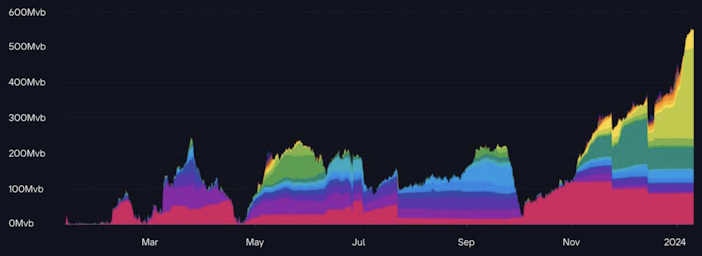

We have seen some fee spikes over the past year, particularly during times of a BRC-20 mint. These fee spikes have raised the cost to use Bitcoin on-chain transactions. As an example, in September, fees to get your on-chain transaction confirmed in the next block were in the 600-700 satoshis/vByte range at the peak level. The fee spikes can be visualized in the chart below from mempool.space.

Meme.pool

While a lot of criticism was leveraged against the ‘JPEGs’ (Regular Ordinal Inscriptions), in actual fact, a lot of the volume was/is coming from text-based inscriptions, such as BRC-20. So, while these BRC-20 transactions are not having as much impact individually in terms of transaction size, they are, to an extent, driving the blockspace / fee market higher. So generally, what we’ve seen is that in low-fee market times, regular monetary transactions, JPEG inscriptions, and text inscriptions are all present in blocks. But as fees rise, JPEG inscriptions tend to be priced out because of their large size. As fees really rise, we still see a lot of BRC-20 transactions because of how small the transactions are and how fee-insensitive these transactors tend to be. Why is this? Probably because of the time pressure to ‘mint’ BRC-20 tokens before the limited opportunity is gone, and this is what causes very high time preference bidding (aka high fee tolerance) in order to get a ‘mint’ transaction confirmed quickly. For example, after a BRC-20 has been ‘deployed, ’ people compete in the open blockspace/fee market to ‘mint.’

Considering things from a Bitcoin miner perspective, this is a boon to their bottom line. We have seen consistently full Bitcoin blocks for some time now, and we’ve seen Bitcoin transaction fees become a meaningful part of the Bitcoin block reward. Previously, the Bitcoin block reward was mostly made up of block subsidies, and historically, we only saw transaction fees become meaningful during heated Bitcoin price bull runs. Perhaps, post-ordinals, this is changing, and there will be a persistent backlog of transactions to fill blocks.

The anti ordinals, pro-filtering side

This group generally views these non-monetary transactions as spam or spammy and that they are bringing a “token pump and dump” dynamic to Bitcoin. They might also argue that the purpose of Bitcoin is for financial transactions, not arbitrary data file storage. The ‘ability’ to store arbitrary data into Bitcoin is seen as a bug by this group, and they believe it should be patched, even if imperfectly. Perhaps in a way akin to email and email spam, the mere fact that somebody sends you a ‘valid email’ is not itself a reason that you must read those emails. So, too, with Bitcoin transactions that Bitcoin nodes do filter for various reasons, e.g., DDoS protection or other invalidness rules.

This camp believes that putting in filters at the Bitcoin node mempool level should be done to discourage spam. In other words, this would mean that Bitcoin nodes which run this kind of filtering would not recognize them as valid and they would not forward the inscription transactions on Bitcoin’s relay network.

However, Bitcoin Core developers do not agree with this filtering approach, so for now, inscription filtering is only applied within an alternate implementation, Bitcoin Knots (maintained by Luke Dashjr).

Another argument here could be that the monetary network of Bitcoin is being slightly degraded as the inscriptions crowd out monetary transactions. And in some ways, it could be argued that the BRC-20 transactions disproportionately price out other transactions. Of course, many people suspected that on-chain transaction fees for Bitcoin were going to rise eventually anyway and that this is just a premature fee rise. For monetary-focused users, though, it is perhaps lamentable that this prices out some individuals from Bitcoin self-custody.

The anti-filtering side

Some in the anti-filtering camp make various arguments: Bitcoin is permissionless, and users of the system should acknowledge that there will be other uses of the chain. They might also argue that there is no easy way to make sure that Bitcoin is only used for financial transactions, given the overall censorship-resistant design of Bitcoin.

Attempts to filter transactions will just result in the inscription users finding even more pollutive or destructive ways to do what they want to do, e.g., instead of regular ordinal inscriptions, they would encode their messages into the UTXO set in a way that can’t easily be detected. This perspective was explained here by long-time Bitcoin researcher and developer Andrew Poelstra. Alternatively, if transactions are filtered at the mempool level, they can instead be sent directly to mining pools “out of band” (i.e., not over the standard Bitcoin relay network). And because these transactions are consensus valid, i.e., your Bitcoin node will not reject these if they are included in a valid block by miners, it would mean mempool filtering becomes mostly futile.

Not wanting to risk losing the mempool as a mechanism for the decentralized use of Bitcoin may push people towards centralized ways of submitting transactions. For example, instead of sending a Bitcoin transaction normally through your Bitcoin node over the network, you could go to a miner and give them the transaction out of band and pay them out of band for them to include it in their next block. Ben Carman has spelled this out in his post here for those interested.

Increased node running costs are arguably marginal, given the substantial decrease in hard drive costs over the years. Cheap 2TB SSD drives nowadays are available for, say, $120 USD and would likely last another 10 years at the current pace. It’s worth noting that the limits set by Bitcoin developers in terms of block size were conservative.

Those interested in feedback collected on a specific Bitcoin Core Pull request can also view Gloria Zhao’s summary of related arguments pro and against here.

Value density

Perhaps the real longer-term answer is that we must increase the value density of on-chain transactions. This can be done by using other layers, such as Lightning, to aggregate more transactions. For example, if you use two on-chain transactions to open and close a Lightning channel, but while that channel was open, you did thousands of off-chain transactions — you packed a lot more value density into those two on-chain transactions. Thus, you’d be willing to pay more for those on-chain transactions, which in turn helps you justify paying high on-chain fees because, fundamentally, it’s now worth it to you. As more Layer 2 protocols come online or continue advancing, the value density increases. This may be the point on which most people can agree, whether they are pro or anti-filtering. In this way, monetary transactions could outcompete ordinal/inscription transactions through economic incentives.

So what’s the bottom line?

Ordinals and Inscriptions are not ideal for monetary users of Bitcoin, but they are not currently a systemic issue for Bitcoin. While it may be an issue for specific individuals who are priced out of self-custody, Bitcoin was always going to be subject to the free market forces of those who want to use Bitcoin’s blockchain. In the short term, it may be best to ‘bite the bullet’ and wait the ordinals and inscription users out. There is still some chance this is a passing fad. But even if it is not a fad, increasing the value density of monetary transactions seems best over the medium to long term.

Credit goes to Brandon Black (aka reardencode) from the Swan team and Mononaut from the mempool.space team for their insights that helped with this article.

If you enjoyed this article about Ordinals and want to learn even more, check out our What Are Ordinals blog post.

Investing in Bitcoin is a strategic decision for securing your financial future.

Don’t waste your hard-earned Bitcoin. Rather than risking your rare and valuable Bitcoin on fleeting digital trends, consider the long-term benefits of holding onto your Bitcoin.

By focusing on sustainable investment strategies, you ensure that your Bitcoin remains a valuable asset for years to come.

Buy Bitcoin with Swan today!

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?