Am I Too Late For Bitcoin

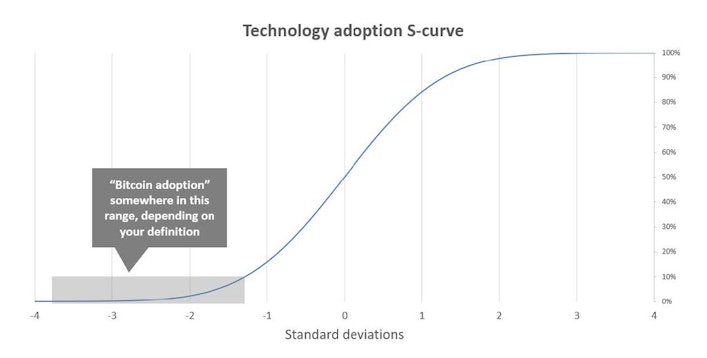

There are different levels of Bitcoin adoption. By segmenting BTC adoption, it becomes easier to see why the wide range of estimates exists but, more importantly, how early adoption of BTC as a preferred store of value.

Thirteen years into Bitcoin’s existence, it’s easy to believe that most of its growth is behind it. Part of this is the result of the bias we all share that causes us to imagine the current state of things as their terminal stage of development. However, when we apply critical thinking to assess where Bitcoin is in its growth trajectory, we find the opposite is true: it is still very, very early.

There are two ways to think about how early it is for Bitcoin as a store of value asset:

Valuation as a percent of its full potential

Adoption as a percent of its full potential (the focus of this article).

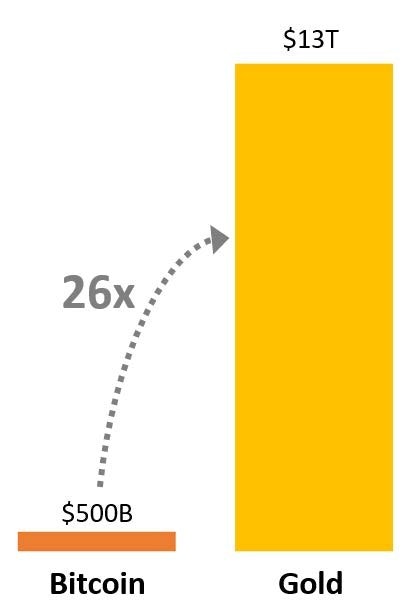

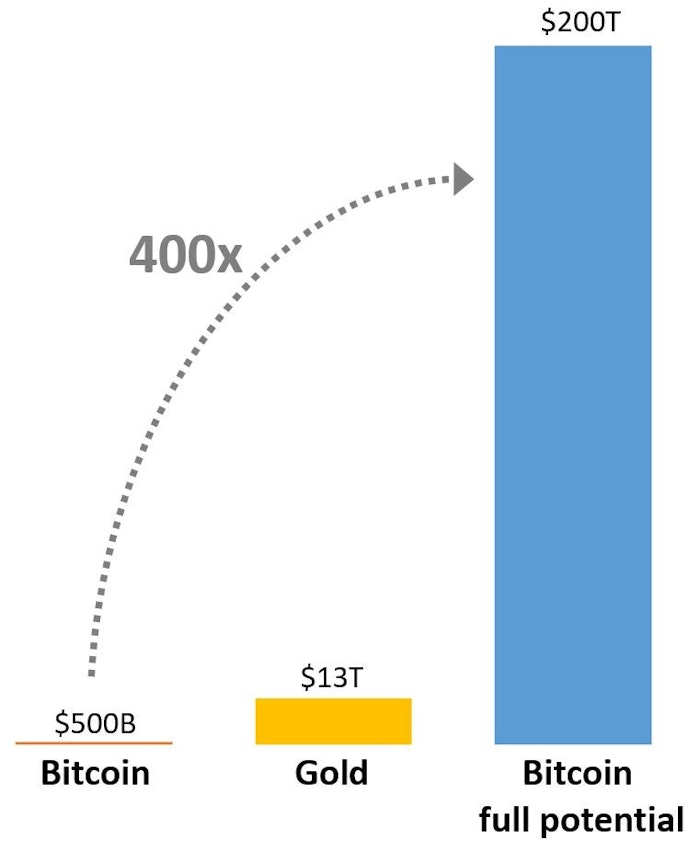

The first and most common way to assess how early it is for Bitcoin is to look at its total value (currently ~$500B) and compare that to its full potential.

The challenge with this is that Bitcoin’s full potential is a matter of speculation. Those who deeply understand Bitcoin tend to view its potential as at least that of gold (~$13T) but theoretically more like $200T (about half the world’s total value).

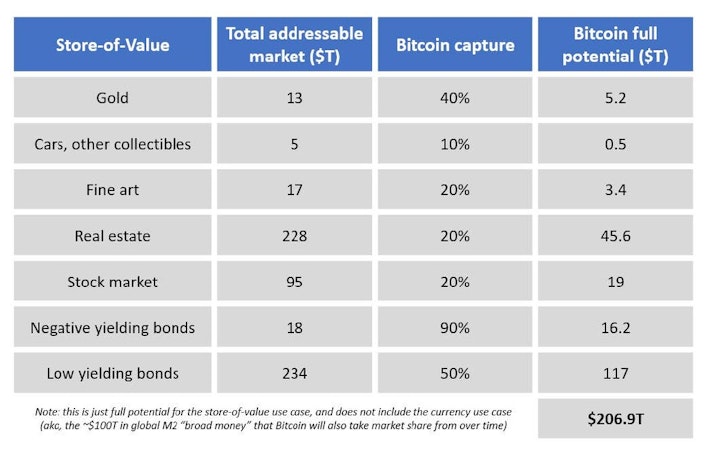

For a quick overview of this $200T potential, let’s look at Bitcoin’s total addressable market.

For simplicity, we will look at the store of value role and ignore its potential to eat market share from the ~$100T in total value sitting in the world’s various currencies. By taking stock of the different store-of-value assets and roughly estimating what % Bitcoin could capture from them, we get a result like this:

While the path to $200T is not a huge stretch, at face value, it feels too good to be true. Since it’s unprecedented for a store of value commodity to attain a value greater than gold, it’s simply uncharted territory. But even if we stick with the lower target value by matching gold’s $13T, Bitcoin still has a lot of price growth ahead.

Anyone considering storing some of their hard-earned money in Bitcoin asks themselves, “Am I early or late?”

Invariably, everyone feels late when they arrive. There are endless examples of people lamenting how late they were in 2011 or 2013, or 2016, when Bitcoin’s price was $5, $100, and $600, respectively.

Like with any growing community where scarce real estate is involved, newcomers are envious of the claims that people have already secured without realizing that the people who have yet to come will be envious of them. This phenomenon holds true when every frontier develops. For example, latecomers to the California gold rush would have been disappointed to find the rich gold fields already spoken for and might have settled instead for a few hundred acres of ranch land now worth a fortune.

At the heart of this sentiment is the fear that there is no more upside left, no more money to be made by staking claim to what’s still available. Have we reached that point with Bitcoin?

Well, no. It is the opposite. Based on the full potential valuation range we established above, even in the low-end outcome ($13T), the vast majority of the wealth that will be gained by Bitcoin holders has yet to be made (96%). To match gold’s valuation, Bitcoin still has to grow 26x.

And if the high-end outcome is the case, a complete 99.7% of Bitcoin’s total wealth generation remains ahead. This would mean Bitcoin still has 400x to grow, dwarfing the gold milestone.

By putting Bitcoin’s current valuation into perspective, it becomes clear that it’s still very early for Bitcoin.

While this analysis suggests there may be anywhere from 26x to 400x upside remaining for Bitcoin, it’s helpful to cross-check this conclusion through a different line of reasoning where the full potential is known…

Estimates of the number of Bitcoin holders worldwide vary widely. This has led to a fair amount of ambiguity and uncertainty about the actual numbers and a certain degree of resignation that this number is simply too hard to accurately assess. While it is hard to nail down a definitive number, the main reason for the variance in estimates is a lack of standardized definitions of what Bitcoin adoption means.

The truth is that there are different levels of Bitcoin adoption. By segmenting Bitcoin adoption, it becomes easier to see not only why the wide range of estimates exists but, more importantly, how early adoption of Bitcoin as a preferred store of value still is.

For these purposes, let’s segment Bitcoin adoption into four different “levels”:

Casual dabblers (toe dippers)

1% allocators (ankle deep)

Significant believers (waist high)

Bitcoin maximalists (gone snorkeling)

Before we begin, we need a denominator. We could use global population, but IMO this skews results. We’re really assessing what percentage of the world with some wealth to store in Bitcoin has done so. According to Statista, 2.2B people in the world have at least $10k in net worth, which seems like a reasonable threshold for having meaningful wealth to store.

In truth, impoverished communities will also use Bitcoin as a store of value. They will arguably derive greater utility from it due to marginal access to traditional banking infrastructure as “low value” bank customers.

However, for our purposes, we are simply looking at how many people have adopted Bitcoin among the group with meaningful wealth to store, so 2.2B will serve as our full potential market size.

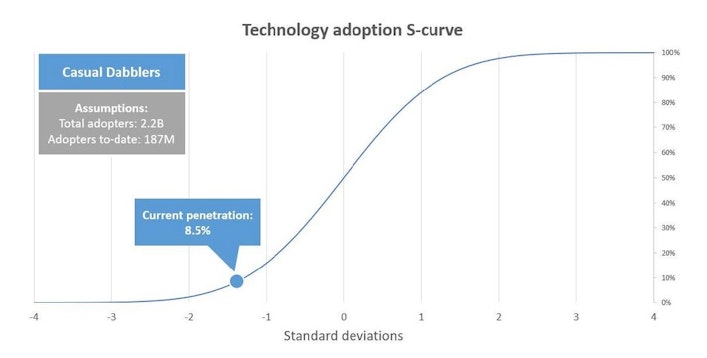

Casual Dabblers

This segment of adopters includes everyone with any amount of Bitcoin — your friend with $20 of BTC in a wallet somewhere or your aunt who can’t remember her Coinbase password from 2017. In my opinion, much of the confusion around how many people have adopted Bitcoin comes from conflating “casual dabbler” adoption as full-fledged Bitcoin adoption.

The reality is that these tinkerers are mostly just experimenting, whether to get a sense of what everyone is talking about or to throw a few dollars into Bitcoin in the hopes that you might hit the jackpot like you might do with lottery tickets.

For this reason, the “casual dabblers” are the red herring of Bitcoin adoption. Their behavior does not actually constitute adoption and, therefore, should not be counted as meaningful Bitcoin adopters. In truth, when dabblers realize that Bitcoin is the best store of value assets in history, they won’t stick with their $20 of Bitcoin.

Instead, they will transition their savings into more meaningful amounts.

In terms of sizing this contingent, Willy Woo put together a reasonably exhaustive and inclusive estimate of ~187M total Bitcoin adopters, meaning that they are “casual dabblers” at minimum.

Using this and our full potential of 2.2B people as a denominator, 8.5% of potential Bitcoin adopters have reached the “casual dabbler” level of Bitcoin adoption.

This is a relatively high number and entirely misleading of the true extent of meaningful adoption, as subsequent segments will show.

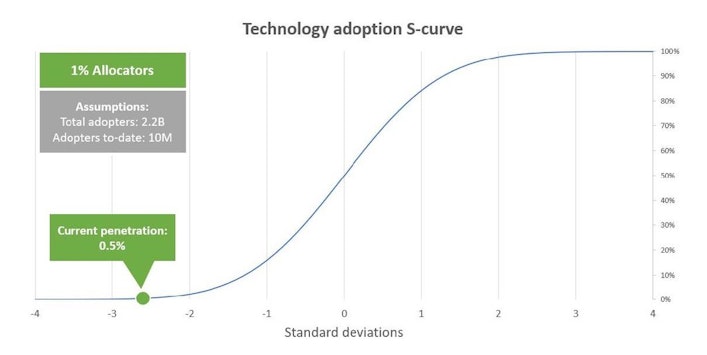

1% Allocators

For the remaining subcategories, accurate data is less available. As such, all we can do is come up with reasonable estimates via triangulation.

In my mind, the “1% allocators” can be characterized as Bitcoin adopters who want to have a small but not trivial allocation to Bitcoin. For our purposes, I think a decent threshold for this group is anyone who has at least 0.1 Bitcoin can be considered to have at least a small but not trivial Bitcoin position.

Looking at the Bitcoin blockchain, there are ~3M addresses with at least 0.1 BTC. On top of these on-chain numbers, we have to account for the considerable number of people who have this amount in an exchange or GBTC. Combined, I think it’s reasonable to estimate that 10M people have reached the “1% allocators” level of adoption or higher.

Based on these numbers, only 1⁄17 “casual dabblers” have reached the “1% allocator” level of adoption, meaning that this level of Bitcoin adoption has only achieved 0.5% penetration to date. This steep drop-off is why it’s a red herring to label the large number of “casual dabblers” as full Bitcoin adopters.

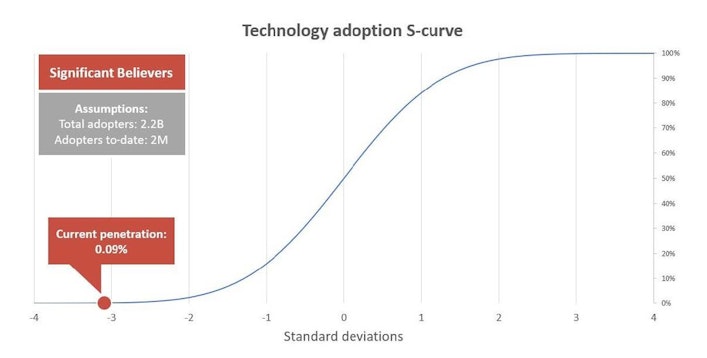

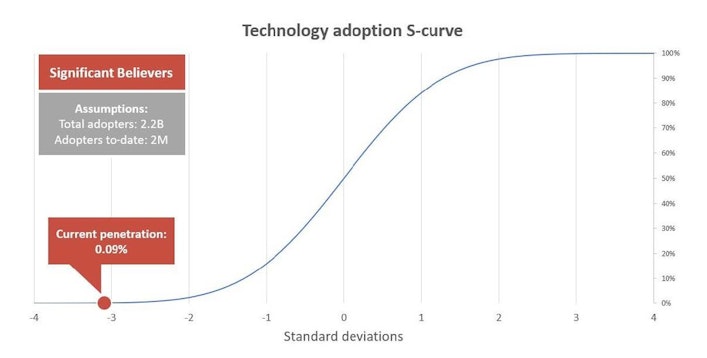

Significant Believers

This category includes anyone who has reached a level of understanding of Bitcoin that a 1% or even 5% allocation no longer seems sufficient. Broadly speaking, this group is in the 5 — 50% allocation range. I would go so far as to say that most of the people who count themselves as believers in Bitcoin, including most of Bitcoin Twitter, are somewhere in this group.

Assessing the size of this group gets much fuzzier, but we can rely on on-chain data to work our way to a reasonable estimate. To start, let’s assert that most people who have reached this level of belief in and understanding of Bitcoin have clawed their way to holding at least 1 Bitcoin.

Additionally, this level of adopter has probably secured their Bitcoin in an on-chain wallet that they control. Looking at on-chain data, ~820k addresses have at least 1 Bitcoin.

As a rough assumption, let’s say that 500k of these are owned by people who have reached the “significant believer” level of adoption at minimum. If we then generously round up to account for people who haven’t achieved wholecoiner status or who are holding their funds on an exchange, we get to a rough estimate of 2M “significant believers.”

Bitcoin Maximalists

For our purposes, let’s say this group includes anyone who has dug deep enough into Bitcoin to conclude that more than 50% of their net worth should be stored in Bitcoin.

Gauging the size of this group is nearly impossible, so we’ll get creative.

“The Bitcoin Standard” sales

Let’s conservatively estimate that only 20% of maximalists have purchased The Bitcoin Standard, and 50% of people who read it became maximalists. Based on the book’s Amazon US rank (6,681), online calculators estimate ~15k copies have been sold.

Let’s generously round that ~15k number up to 50k to account for international sales and non-Amazon purchases.

This nets an estimate of 125k maximalists. To err on the side of caution, let’s double that and call it 250k.

Qualitative Triangulation

Purely subjective, but it seems to me that there are maybe 10k actively engaged Bitcoin maximalists on Twitter, the primary home of maximalist communication. To be very conservative, let’s say this represents ~5% of maximalists (200k total).

Additionally, as a top-down assessment, it seems reasonable that ~10% of people who have reached 5 — 50% Bitcoin allocation have made the leap to maximalism.

All in all, ~250k Bitcoin maximalists seems a conservative, if not generous, assumption.

That puts us at 0.01% penetration.

Either way, if you look at the numbers, it’s still very early for Bitcoin. By looking at Bitcoin’s valuation as a percentage of its full potential, we see that Bitcoin’s current value is somewhere between 0.2% and 3% of its eventual end state, meaning 30x to 500x upside remains.

By looking at Bitcoin’s adoption progress, we see that Bitcoin’s current adoption penetration is between 0.01% and 8.5%, depending on what threshold of adoption you look at.

If you believe, as I do, that Bitcoin is on a path to becoming the dominant store of value and preferred money for the world, eventually, the norm will be to have more than 50% of their net worth in Bitcoin. Since our analysis here suggests that only 0.01% of the world already meets this threshold, it stands to reason that 99.99% of the world remains to follow.

Overall, while everyone who shows up to Bitcoin inevitably feels the pangs of regret for not investing sooner and wonders if they missed the boat entirely, it’s clear that most of Bitcoin’s growth remains ahead. To put this in context, since there will only ever be 21M Bitcoin, the average person (out of 8B people) will have just 0.0025 Bitcoin.

It is still so early that this average person’s total net worth in Bitcoin can be purchased for just $60. You are still very early, congratulations, and enjoy stacking those sats while they’re still this cheap!

This blog offers thoughts and opinions on Bitcoin from the Swan Bitcoin team and friends. Swan Bitcoin is the easiest way to buy Bitcoin using your bank account automatically every week or month, starting with as little as $10.

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?