Alto Crypto IRA Review 2024: What 1K+ Reviews Tell Us

Alto Crypto IRA is a well-know self-directed Bitcoin and crypto IRA platform. Alto lets investors trade altcoins in their retirement account. But how does it stack against Bitcoin-only Swan IRA in 2024? Let’s find out!

Swan Bitcoin IRA

Bitcoin is the ultimate asset for your retirement. Create a tax shelter for exponential returns! Get started in less than 2 minutes. Book a call with one of our Bitcoin IRA specialists today!

In this comprehensive Alto Crypto IRA review, we will take a closer look at the following key highlights:

We will also compare the competitive benefits of Bitcoin-only options compared to broader crypto IRAs, providing you with the confidence to make informed investment decisions.

Headquartered in Nashville, Tennessee, Alto Crypto launched in 2018 simplifying the self-directed IRA process by allowing individuals to utilize their tax-advantaged retirement funds for investments in alternative cryptocurrency assets.

In contrast to conventional IRAs, which typically revolve around stocks, bonds, and traditional assets, a Bitcoin IRA or crypto IRA allows investors to diversify their portfolios by allocating a portion of their retirement funds into Bitcoin and other digital assets.

Alto Crypto IRA serves almost 30,000 customers and is available to all eligible U.S.-based investors, excluding Hawaii.

Their platform provides access to 200 cryptocurrencies that can be included in your tax-advantaged retirement portfolio.

Alto Crypto IRA Options

Traditional, Roth and SEP IRAs

401(k)s tailored for small business proprietors

Alto Crypto IRA is designed for investors interested in allocating funds across a broad spectrum of alternative cryptocurrencies. It’s most suitable for individuals:

With a greater appetite for risk

More comfortable with higher associated fees

Are experienced in managing self-directed retirement accounts involving. products they may have limited familiarity with

Tax Benefits: Alto Crypto IRA offers tax-advantaged retirement accounts, such as Traditional IRAs and Roth IRAs, allowing you to potentially grow your investments tax-free or tax-deferred.

Diversification: Investors can diversify their retirement portfolio by including alternative cryptocurrencies other than Bitcoin.

24/7 Trading: Alto Crypto IRA provides access to 24/7 trading for cryptocurrencies, which can benefit investors who want to take advantage of price fluctuations at any time.

Easy to Use: The platform is user-friendly, making it accessible for experienced and novice investors.

Market Volatility: Cryptocurrencies are known for their price volatility, which can lead to significant gains or losses. Investors need to be aware of the risks associated with these assets.

Regulatory Changes: The regulatory environment for cryptocurrencies is evolving, and changes in regulations could impact the way Alto Crypto IRA operates and the assets it offers.

Limited Options: Does not support opening a solo 401k or SIMPLE IRA option. Some Alto Crypto IRA offerings are only available to accredited investors (those with a net worth of at least $1 million or annual salary of $200,000, or $300,000 for couples) and non-accredited investors).

Educational Resources: Alto Crypto IRA doesn’t offer dedicated educational material, content and resources to help users stay informed.

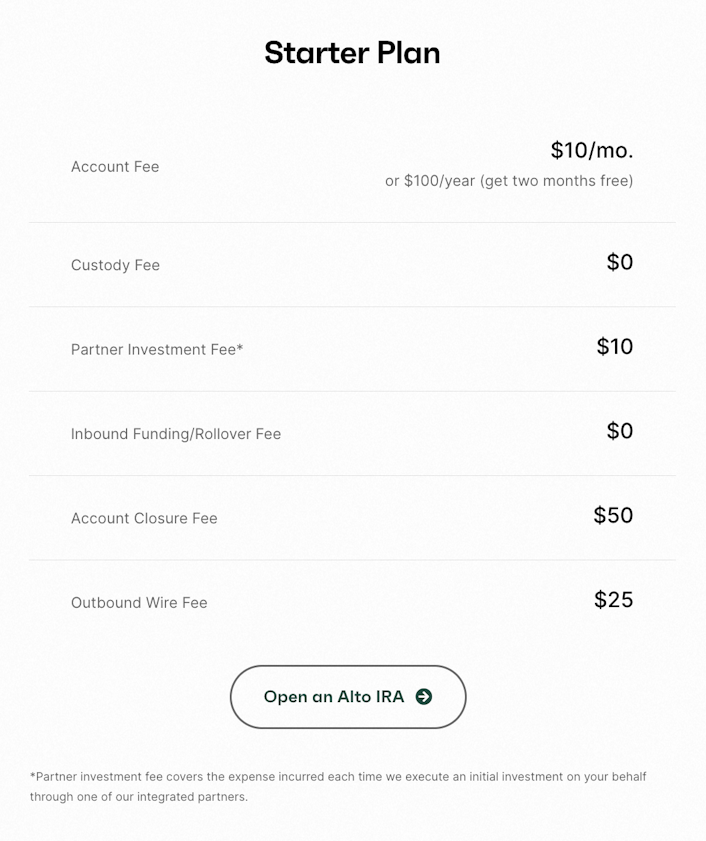

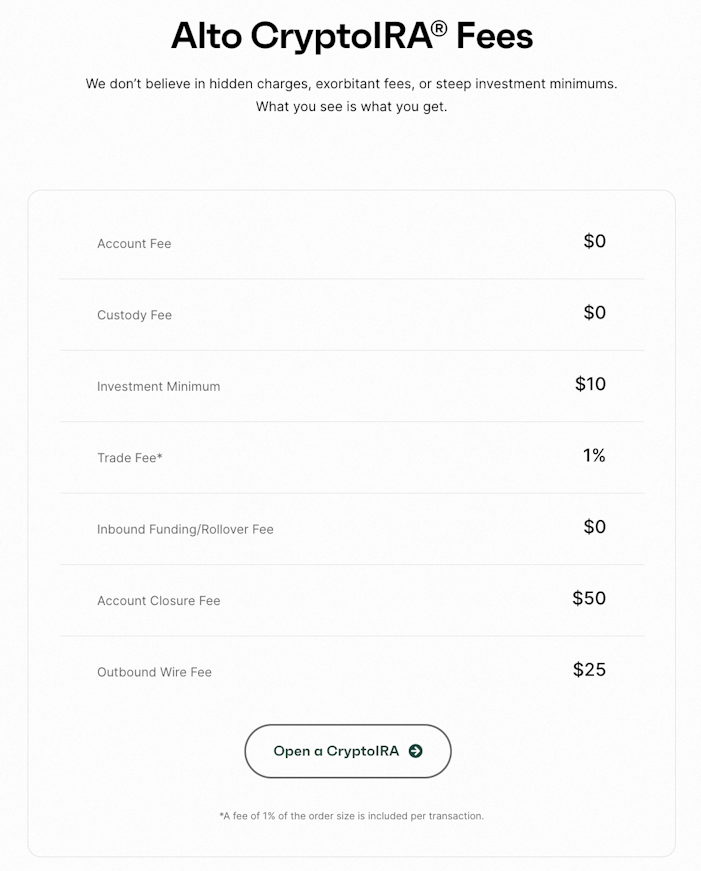

Transaction fees are associated with purchasing and selling cryptocurrencies, with the precise amounts varying based on the specific cryptocurrency being traded.

Alto Crypto IRA charges a $25 outbound wire transfer fee.

With Pro, investors can invest in opportunities outside their existing investment partners, and get access to everything available in the Starter Plan, too.

Alto Crypto’s IRA fee structure appears competitive initially, especially with its no-custody fee policy. However, investors should carefully weigh the monthly or annual account fees, which can significantly increase over time.

The Pro Plan offers more investment options but comes at a higher cost.

Swan Bitcoin IRA stands out for its:

Alto Crypto IRA is rated 4.4 out of +1.2k reviews

Swan scores a notch higher with 4.6 out of 5 stars from +1k reviews

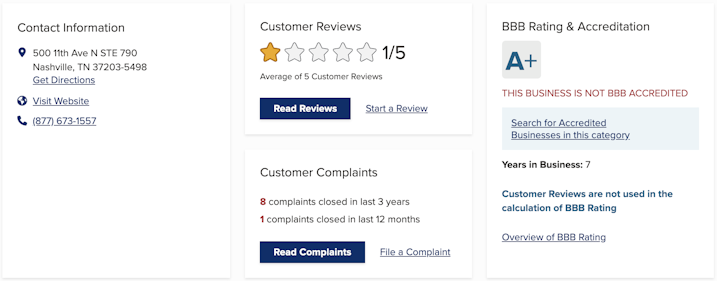

However, Alto Crypto IRA scores a dismal 1 out of 5 stars with the Better Business Bureau.

Swan has an ecosystem packed with high quality information and provides great resources…

Each provides some of the best insight and content from industry leaders about why Bitcoin is the ultimate asset for your IRA.

Alto Crypto does have a blog, but has not made a new post since December 22nd, 2022. They provide very little education on its website or social media accounts for its customer base.

Its YouTube channel only has 136 subscribers with 32 uploads. Their last upload happening over a year ago.

Alto Crypto’s research section is limited to only one 17-page PDF report titled Alto’s 2022 Alternative Investing Report: Alto IRA.com How Millennials See Their Financial Future.

Swan’s YouTube channel has 77.4k subscribers and provides new uploads daily — with +1.5k uploads.

Social Media Presence

Alto’s Crypto Twitter page only has 4k followers, despite having an account since 2018. Although they tweet regularly — most of their posts only usually receive a small handful of likes with little to no engagement or re-tweets.

Swan has multiple Twitter handles. All of them experience a much higher engagement rate than Alto Crypto and have a focused approach.

The Swan Client Services account has 94.2k followers and the primary Swan account has more than 25.3k followers.

Compliance and Risk Focus

Swan prioritizes minimizing potential risks associated with investing in and holding Bitcoin in a legal trust in your name, expertly handling regulatory and compliance concerns concerning your IRA.

Tailored for Bitcoin

With Swan Bitcoin IRA, you embrace a Bitcoin-only strategy, avoiding exposure to volatile altcoin securities as seen with Alto. Alternative cryptocurrencies always carry significant regulatory and counterparty risks, exemplified by recent SEC actions.

No Promotion of Altcoins

Unlike Alto Crypto IRA and many other Bitcoin and crypto IRA providers, Swan does not promote alternative cryptocurrencies to encourage excessive trading activity and fees. While trading altcoins in your IRA tax-free is possible, it’s crucial to recognize that the primary beneficiary of such trading, in the long run, is likely the IRA provider.

Helpful Support

The Swan Support team of Bitcoin experts is readily available, responsive, and enthusiastic about discussing everything related to Bitcoin.

Alto Crypto IRA offers +200 alternative cryptocurrencies, presenting a diversification strategy that may seem appealing but carries inherent risks including:

Market volatility

Regulatory and legal challenges

Security and fraud vulnerabilities

Tax implications

When considering your retirement, the primary objective should be preserving and growing your wealth over the long term.

Treating your retirement portfolio like a trading account, constantly chasing crypto market trends, is a recipe for disaster.

Swan encourages customers to use a low-time preference mindset of dollar-cost-averaging and smash buying the significant correction periods instead of trading.

Bitcoin presents itself as a typical investment, with numerous advantages and promising growth potential.

Before making any investment, it is crucial to conduct thorough research and prioritize the protection of your savings while positioning yourself for long-term price appreciation in the secure asset that Bitcoin offers.

Mixing your Bitcoin portfolio with unregistered securities and altcoins is very risky.

It’s prudent to consider opting for a “Bitcoin-only” approach when choosing an IRA provider.

Make sure to have a clear understanding of the fees associated with the IRA and how they might impact your long-term retirement objectives.

Who Owns Alto Crypto IRA

How Does Alto Crypto IRA Work?

The platform offers a self-directed IRA, enabling investors to integrate digital assets into their retirement portfolios.

Can I Invest My 401(k) in Bitcoin?

You have the option to initiate a new account with Alto Crypto IRA or transfer funds from an existing IRA or retirement account, like a 401(k), and allocate those funds to various cryptocurrencies.

What are some Alto Crypto IRA Alternatives?

What are the Investment Limits for Alto Crypto IRA?

There are no maximum investment limits.

Is Alto Crypto IRA Tax-Exempt?

The funds and assets within your account remain tax-free as long as they stay within the IRA.

On November 21st, 2023 Alto Crypto announced an expanded partnership with Farmland LP. Farmland is one of the largest fund managers specializing in organic farmland.

Farmland LP is making its Vital Farmland Fund III available on the Alto Marketplace, allowing accredited investors to invest in a real asset-managed farmland fund.

Simplicity and Focus

Bitcoin-only platforms provide a straightforward user experience, directing all their resources towards Bitcoin-related services.

If your sole interest lies in investing in Bitcoin, a streamlined platform that avoids the complexities of managing multiple cryptocurrencies is the ideal choice for you.

Specialized Expertise

Platforms like Swan Bitcoin possess in-depth knowledge of Bitcoin’s technology, market dynamics, and trends.

Our specialized expertise allows for tailored advice, research, and support exclusively focused on Bitcoin investments.

Enhanced Security

Bitcoin-only platforms prioritize and optimize security measures specifically designed for Bitcoin.

This may include robust encryption, multi-signature wallets, cold storage solutions, and other security practices to safeguard Bitcoin holdings.

Access to Specific Bitcoin Features

These platforms grant access to unique features or services exclusive to Bitcoin.

For instance, opportunities like Bitcoin lending, staking, or other specialized investment options are unavailable on broader platforms.

Lower Fees

Bitcoin-only platforms often come with lower fees than broader platforms that support multiple cryptocurrencies.

By choosing a Bitcoin-only IRA platform, you can capitalize on the platform’s expertise and tailored services while focusing solely on your Bitcoin investments in a secure and cost-efficient manner to help you avoid the complex jargon and hidden fees of crypto IRAs.

Including unregistered securities and altcoins in your Bitcoin portfolio carries an exceedingly high risk.

A “Bitcoin-only” approach when selecting an IRA provider should be among your top priorities. To gain a deeper understanding of Swan Bitcoin IRA and its capacity to assist you in attaining your retirement aspirations while optimizing your savings.

For additional information, please don’t hesitate to contact our team at ira@swanbitcoin.com.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?