A Fed Pivot Releases Animal Spirits

It seems like things are all lining up for Bitcoin to have an explosive year in 2024.

Swan Bitcoin Market Update #45

This Insight Report was originally sent to Swan Private clients on December 8th, 2023. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

This week was more important than most when it came to markets given that we had two major events transpiring at once with the release of the latest CPI data as well as the Federal Reserve’s December FOMC meeting.

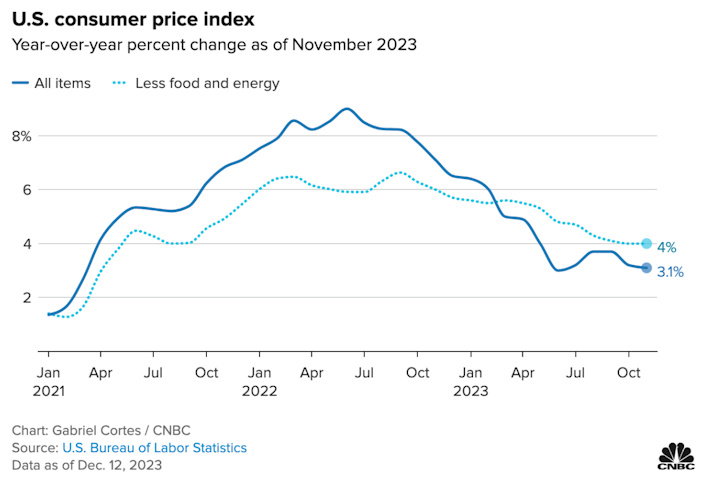

CPI inflation declined from 3.2% YoY in October to 3.1% YoY in November. However, Core CPI — minus food and energy — remained unchanged from last month at 4.0% YoY.

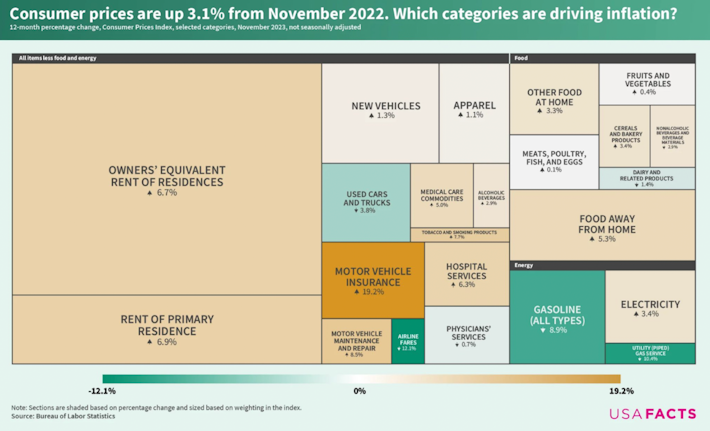

When diving deeper into the CPI data, one can see that the shelter component continues to keep the overall headline number elevated, while energy continues to see a significant decline.

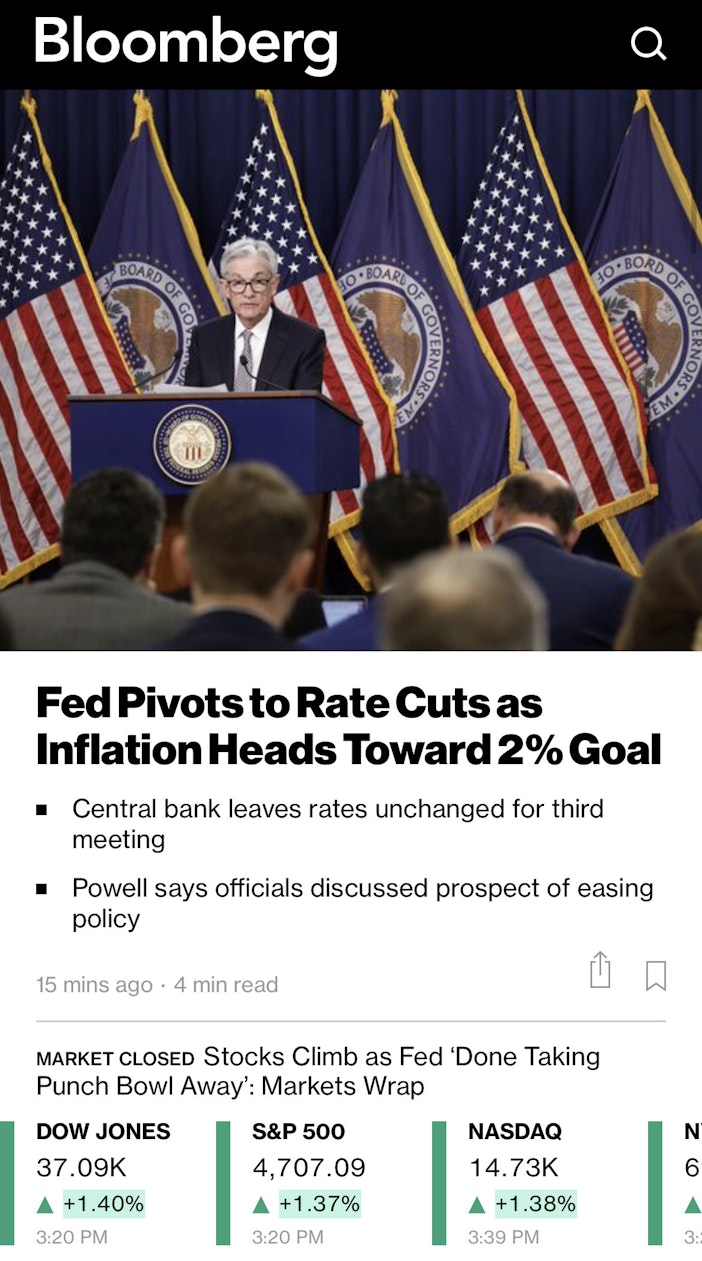

This positive inflation print led us to the much-anticipated FOMC meeting, and Fed officials did not disappoint.

It was only a month ago when Fed Chairman Jerome Powell stood at the podium and said, “The fact is, the committee is not thinking about rate cuts right now at all. We’re not talking about rate cuts.”

It’s amazing what can happen in a month’s time. In the latest post-FOMC press conference, Powell seemingly has made a complete 180 stating that the timing of any coming rate cuts “is clearly a topic of discussion in the world and a topic of discussion for us at our meeting today.”

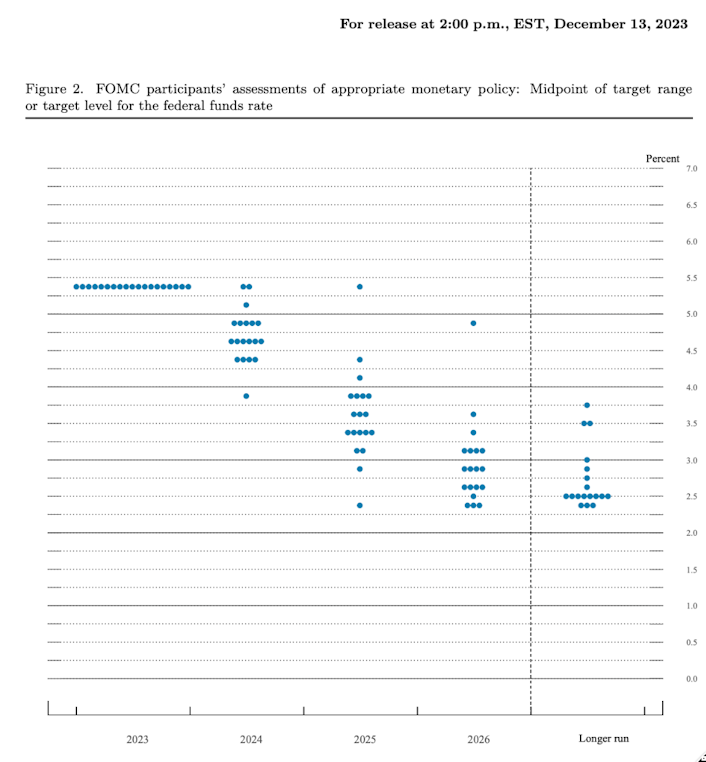

Furthermore, the updated Fed dot plot shows the median interest-rate forecast for 2024 is 4.6%, compared to 5.1% in September. This implies that Fed officials are now expecting at least two 0.25% rate cuts to occur next year.

Federal Reserve

Jerome Powell’s messaging in the press conference can only be described as incredibly dovish. He reported that the Fed is “likely at or near the peak rate for this cycle.”

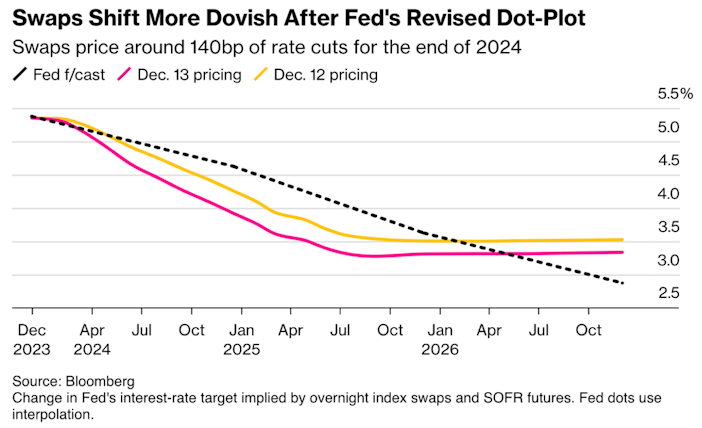

The market is now pricing in even greater rate cuts than Fed officials. Futures are now implying around 1.4% of rate cuts by the end of 2024.

The market reaction to Powell’s speech was noticeable across all assets. Animal spirits returned with full force. The stock market rallied, bond yields fell dramatically and gold and Bitcoin both ripped.

I think this screenshot summed it up well. It shows the headline of the Fed pivot with the stock market in the green and the added comment of “stocks climb as Fed done taking the punch bowl away.”

With markets at risk of rising substantially on the messaging and causing more inflationary pressures, in typical Fed fashion, New York Federal Reserve President John Williams came out the very next day to backtrack on some of the messaging stating, “We aren’t really talking about rate cuts right now, ”

But the damage likely has already been done. The markets are broadly viewing Powell’s comments as the long-awaited “Fed pivot” that they have been waiting for.

It leads to the question, why now? With inflation still above the Fed’s target, the unemployment rate still at multi-decade lows, nominal GDP still running hot, and stocks near all-time highs, why is the Fed choosing to send the message of easing policy now?

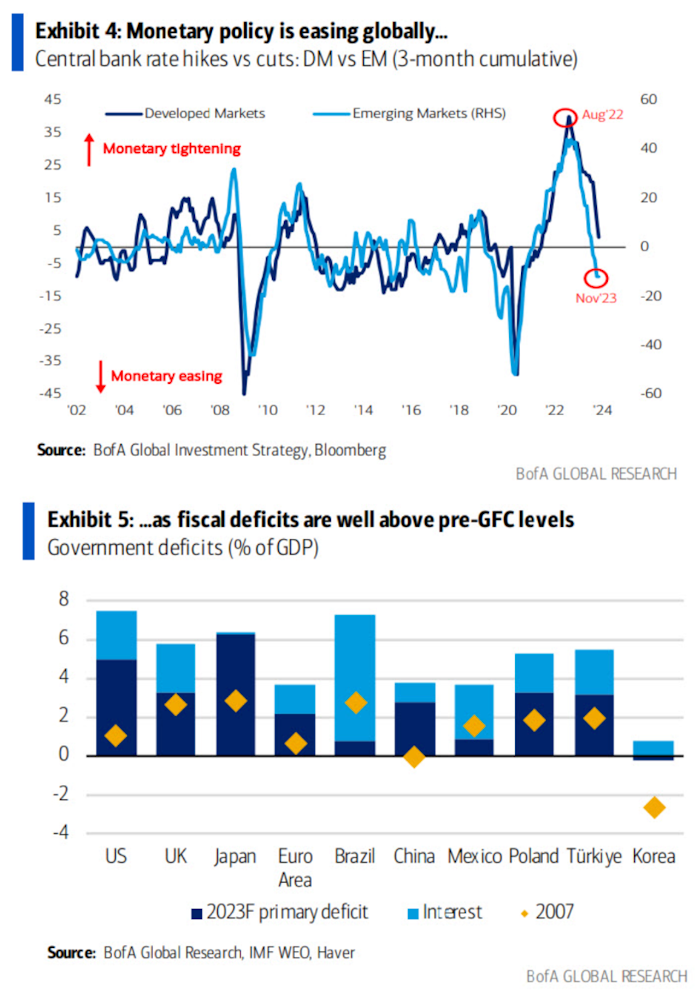

A potential explanation is that their monetary policy decisions are increasingly being influenced by fiscal policy. This trend can be seen globally.

As central banks have begun to ease across the globe, fiscal deficits as a percentage of GDP remain elevated.

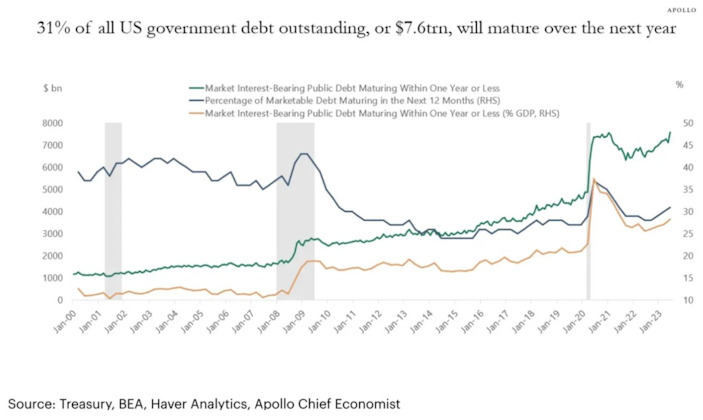

For Treasury officials, higher rates pose a challenge to fund their massive fiscal deficits. 31% of all US government debt outstanding is set to mature over the next year. This debt will need to be refinanced, and with rates where they are, that will be an expensive endeavor.

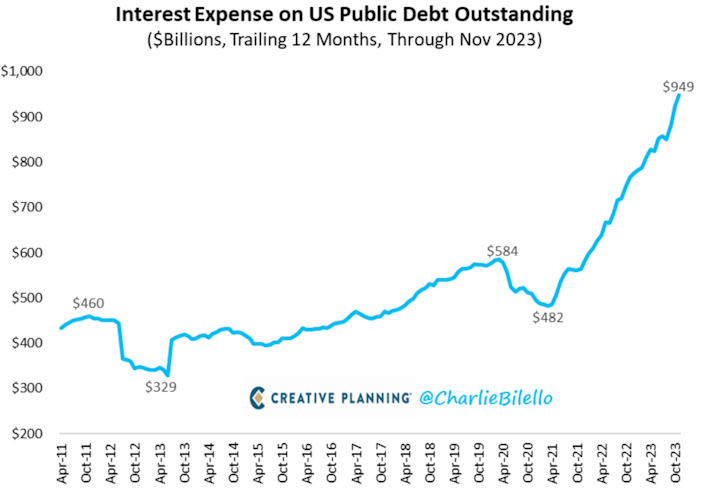

Already, interest expense on US public debt outstanding has exploded as interest rates have spiked.

Said simply, the Treasury needs rates to come down, so they were likely cheering on Powell’s dovish speech as they watched the 10-year yield fall below 4%, the lowest since August. One can only speculate, but it’s difficult to believe that these fiscal dynamics are not on FOMC officials’ minds when they consider interest rate policy moving forward.

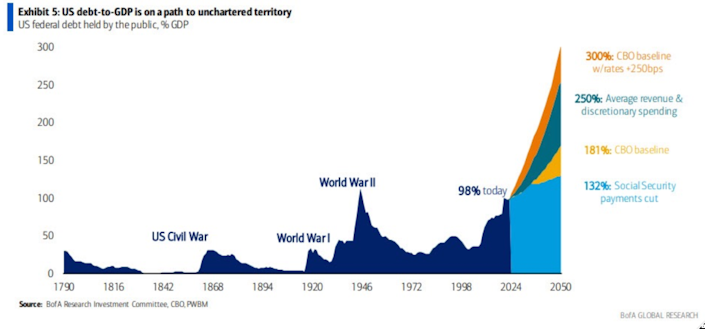

When looking further out, the fiscal picture appears unsustainable, especially in a higher interest rate environment.

This is likely why we heard Treasury Secretary Janet Yellen chiming in on her thoughts about inflation. In a recent interview, she said that she believes inflation is coming down “meaningfully” and that it won’t be difficult for the Fed to finish the “last mile” to get CPI down towards its 2% target.

The other potential explanation for this pivot is that the Fed is worried about the lag effects of their rate hikes. To date, we have not seen the impact of the rise in interest rates on the broader economy, but that can change if rates remain higher for longer and more and more companies and households need to refinance their debts.

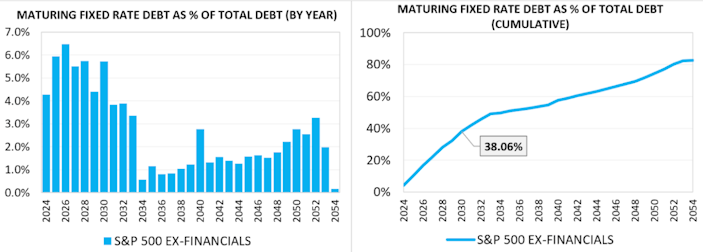

However, if this is why the Fed is pausing, this worry could be unfounded. Recent research from Canvas shows that US corporations have quite the runway to work with when one looks at when their debt matures.

The charts below show that, in 2024, about 4% of S&P 500 debt will mature. By 2030, approximately 38% of the total S&P 500 debt will have matured.

Canvas

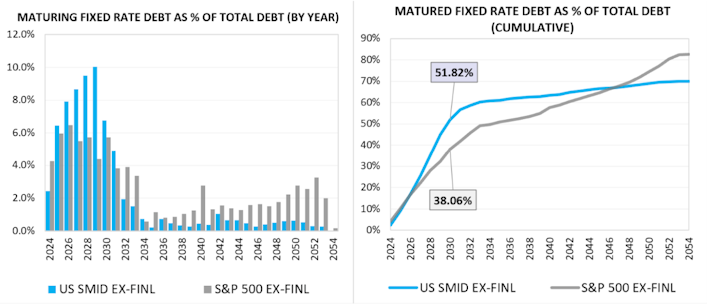

One nuance discovered in their research was that small and medium-sized businesses have less of a runway than larger corporations. By 2030, about 52% of their debt will have matured.

Canvas

This is something to keep an eye on moving forward, especially if we start to see a rise in the bankruptcies of small and medium-sized businesses.

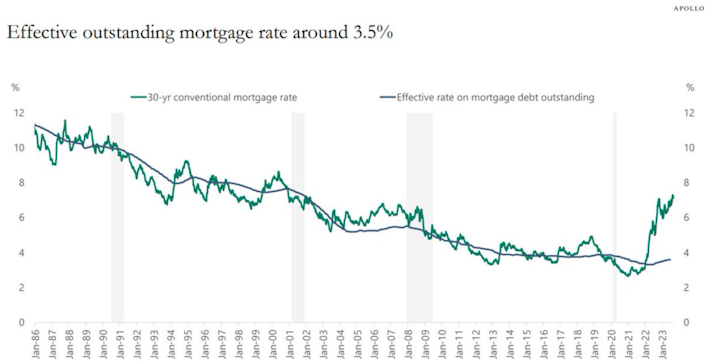

Overall though, it appears corporations have a lot of breathing room when it comes to their debt. This runway is also true of US households when it comes to their mortgages. Today, the effective mortgage rate — the average rate on existing mortgages — sits at 3.6%. This is a huge divergence from the current average 30-year mortgage rate of around 7%.

So households and corporations took advantage of the low-interest rate environment and refinanced their debt, giving them a cushion to survive a higher interest rate environment.

This data leads one to believe that it is likely the government debt dynamics that are causing the Fed to take its foot off the pedal despite asset prices increasing and the economy still running hot.

If this thesis is accurate, then the Fed is not as independent as it likes to lead people to believe, and if the Fed is not independent with its policies, then that means that a third, unspoken mandate for the Fed moving forward is maintaining the affordability for the government to continue to run large fiscal deficits.

In a future of continued trillion-dollar fiscal deficits, real assets like Bitcoin and gold will likely outperform. The long-term, unsustainable fiscal picture makes holding assets that function outside of the traditional financial system an attractive proposition for investors to consider.

Furthermore, Bitcoin has other endogenous factors that could act as a tailwind for its price and help push its adoption to new heights in the coming years.

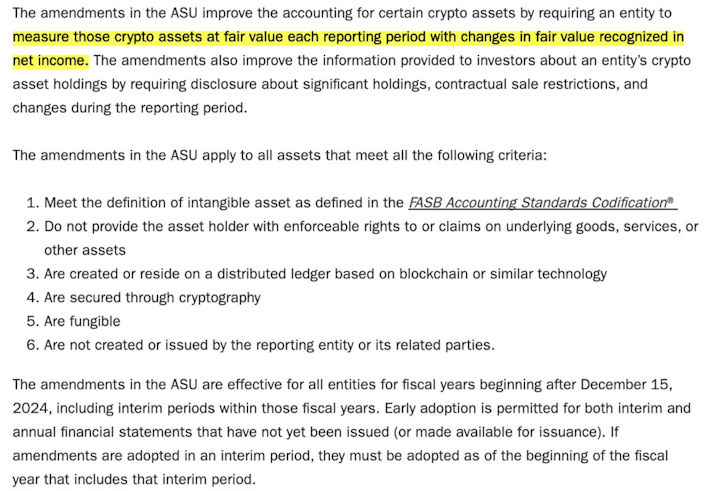

One of those factors is the acceptance of new FASB accounting rules, which will make it easier for corporations to hold Bitcoin on their balance sheets.

This week, FASB officially adopted Fair Value Accounting rules for Bitcoin beginning after December 15th, 2024.

FASB

Up until this point, corporations faced a challenge when attempting to put Bitcoin on its balance sheet due to the way Bitcoin was treated on balance sheets.

Corporations need to classify Bitcoin as an intangible asset, which means If the price of Bitcoin goes down, they have to mark the value lower on their balance sheet, and if the price goes up, they can’t record the gain unless they sell the bitcoin. This creates a huge balance sheet impairment for these companies if the price of bitcoin drops. It creates a situation where a company has to potentially list the bitcoin on its balance sheet at a lower value than the current market price when it is simply holding it.

This accounting upgrade will help facilitate the adoption of Bitcoin as a treasury reserve asset at the corporate level. Industry leaders such as Former PayPal President and Lightspark CEO, David Marcus took to X to point out the significance of the rule change.

This accounting rule change comes as this recent Bitcoin rally appears to be on the radar of corporations.

In November, there were over 1,000 mentions of Bitcoin in SEC filings, an over 30% increase from the same month last year.

SEC Filings

This is an over 30% increase from the high made last May. Corporations are paying attention, and it is about to get a whole lot easier for them to put Bitcoin on their balance sheets.

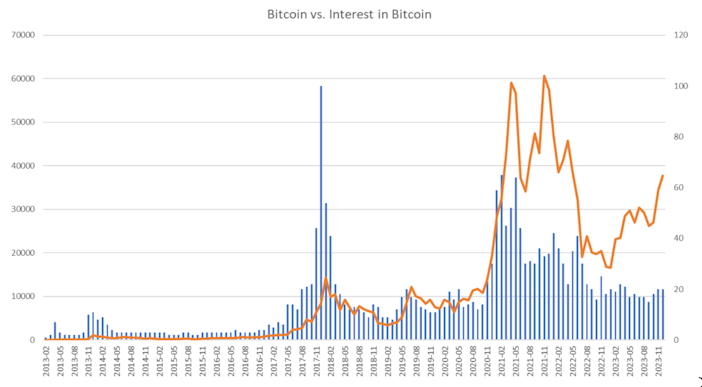

Despite this positive development, interest in Bitcoin as measured by Google trends still remains at levels last seen before the last major bull market, in 2019. The wider public still appears to be unaware that Bitcoin is up more than 140% from its lows last year.

Bloomberg

This lack of public interest despite Bitcoin’s impressive performance this year hints that we are in the very early innings of this bull run.

It seems like things are all lining up for Bitcoin to have an explosive year in 2024. We have increased institutional adoption, a potential ETF approval, the halving event, more favorable FASB accounting rules, and the government will likely need to continue to run massive fiscal deficits. It’s only a matter of time before Bitcoin begins to grab the attention of the wider public, and when that happens, the bull market will really start to gain steam.

Market Overview

Tradingview, Prices as of 12/15/23

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?