A Changed Bitcoin At $50k

Although $50k was close to the cycle high in 2021, the current environment makes it easy to believe that this time, $50k marks the beginning, not the end, of an extraordinary bull run.

After nearly two years, Bitcoin has eclipsed $50,000 per coin once again. After a tumultuous couple of years, during which we saw Bitcoin’s price correct more than 75%, countless headlines stating “Bitcoin is dead, ” many high-profile bankruptcies, and several more high-profile lawsuits, Bitcoin is back above $50,000, marking an impressive comeback.

Bloomberg

However, although Bitcoin’s price is at the same level as it was back in 2021, Bitcoin is not the same asset it was then.

Yes, there are still only 21 million, and the big-picture value proposition remains unchanged, but Bitcoin has matured significantly since then. In many ways, the Bitcoin ecosystem has undergone growing pains and maturation since 2021. Today, as it sits once again above $50,000, it is healthier and stronger than ever. The old parasites and scammers have been washed away, and Bitcoin stands cleansed, ready to flourish in a new next bull cycle.

Let’s dig into some key differences between Bitcoin at $50k in 2021 and Bitcoin at $50k in 2024 to understand why this time is different.

Back when Bitcoin hit $50,000 in 2021, we were nearing the end of a raging bull market. Speculation was running rampant as even drawings of rocks demanded millions at auctions.

Much of the demand in late 2021 consisted of new retail investors chasing gains and trying to guess which meme coin would be the next 100x. This exuberance is emblematic of all bull markets. Bitcoin becomes the focus of everyone’s attention near the top of each bull cycle as new retail investors FOMO in. This is quite literally what makes a cycle top a cycle top. A bunch of uneducated speculators rush in all at once, chasing gains, and then when the price turns, they sell in droves, causing a massive price correction.

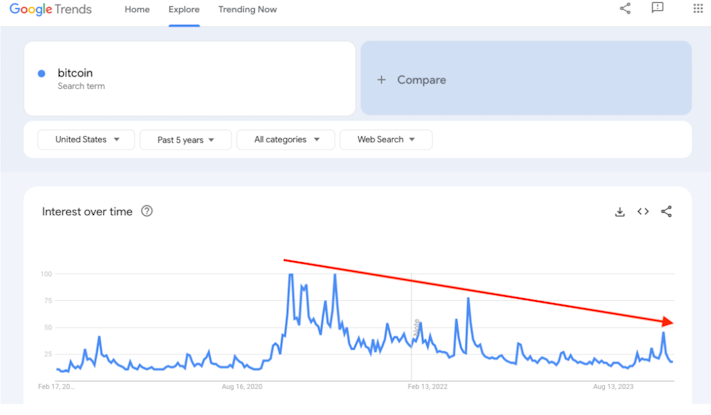

One way to observe this is by looking at Google Trends. Below, one can see how interest in the search term “Bitcoin” spikes near the tops of bull markets. In 2021, interest was at an all-time high. But in 2024, interest in Bitcoin still appears extremely low despite its price rallying past $50,000.

Google Trends

This signals that new retail investors have not yet joined in on this Bitcoin rally that started under $20k and has risen to above $50k. In other words, we are in the early stages of a new bull cycle.

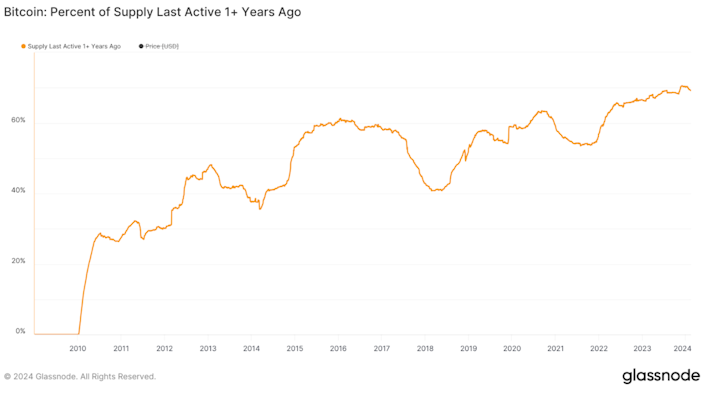

While new retail investors haven’t yet caught wind of Bitcoin’s price action, long-term holders have been holding with diamond hands and are now being rewarded.

Today, 69% of Bitcoin’s circulating supply has not moved in one year or more.

Glassnode

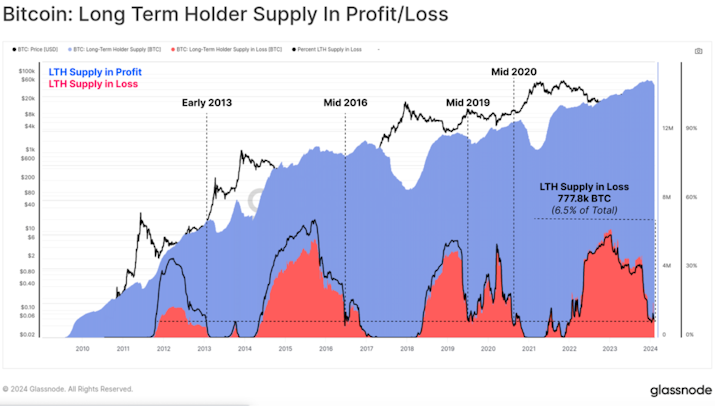

These highly-convicted holders are not selling despite only 6.5% of the total long-term holder supply (coins that have not moved in >155 days) sitting at a loss.

Glassnode: Checkmate

That means that 93.5% of long-term holders are currently in profit, but they are not selling. One can conclude that a logical explanation for this behavior is that these holders are bullish and anticipate higher prices before they sell — or they never plan to sell at all.

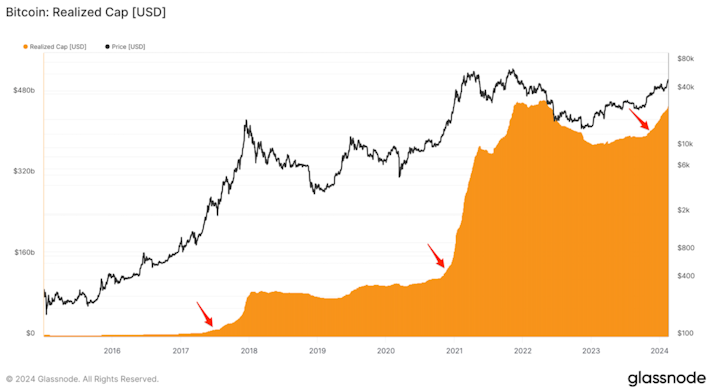

Lastly, “Realized Cap, ” a measure of the cumulative sum of all realized profits and losses, is a good metric to see how many long-term holders are beginning to take profit on the coins they accumulated at bargain prices in the bear market.

Typically, we see Realized Cap rise during uptrends as investors begin to take profit and distribute coins to new buyers at more expensive prices. In bear markets, you see Realized Cap move sideways and decline as expensive coins are revalued lower, as investors capitulate and sell at a loss, usually to more convicted holders at the bottom of bear cycles.

The chart below shows how we have just started to see Realized Cap increase, similar to the beginning of the 2017 and 2021 bull runs.

Glassnode

This chart looks like it still has a lot of room to run, which means that we are likely only in the early stages of this bull cycle.

To summarize, unlike 2021, new retail investors are nowhere to be seen yet now that Bitcoin has reclaimed $50,000. This rally has instead been driven by long-term holders who held and even accumulated through the bear market and are just now being rewarded for their conviction.

Another major difference between 2021 and 2024 is that today, large financial institutions are deeply involved. In 2021, the major players in the broader cryptocurrency world consisted of inexperienced, young entrepreneurs, poor risk managers, or outright scammers. Think of firms like BlockFi, Celsius, Genesis, FTX, Three Arrows Capital, etc.

In fact, we now know that much of the volume in late 2021, when Bitcoin eclipsed $50,000, was actually fake. It was FTX selling fake paper Bitcoin while perpetuating a giant Ponzi scheme that eventually imploded. Over the last couple of years, many of these grifters and scammers have been wiped out and are now paying their dues for their crimes. However, for everyone else who was law-abiding and survived the bear market, this leaves a ton of opportunity to grab market share.

Today, large, respected firms appear to be pursuing this opportunity. The main difference between 2021 and 2024 is the replacement of young, inexperienced startups with large, respected financial institutions with decades-long track records. This makes the ecosystem much more resilient and stable. I think it’s safe to say that the market infrastructure of the Bitcoin ecosystem is in better hands compared to 2021.

Not only that, but all sizes of institutional investors now have a much safer and more efficient method to gain exposure to Bitcoin compared to 2021.

In 2021, the easiest way for institutional and retail investors in retirement accounts to gain exposure to Bitcoin was through GBTC. GBTC was expensive, given its 2% annual fee, and it was inefficient. It often traded at a massive premium or discount to its net asset value (NAV). The lack of viable investment vehicles turned investors away from buying Bitcoin in 2021, but that isn’t the case today.

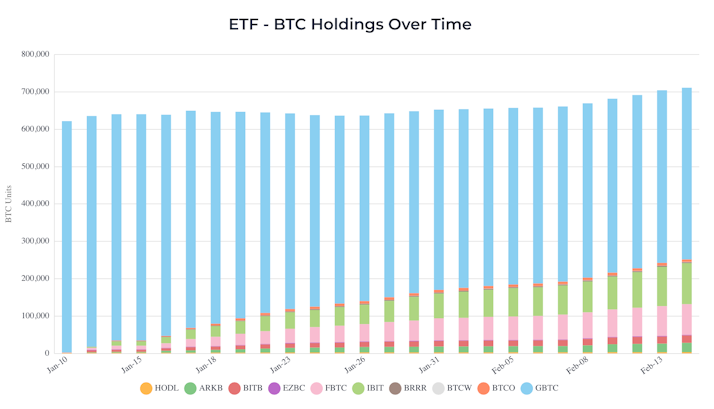

In 2024, investors now have the option to purchase 9 different spot Bitcoin ETFs. These ETFs are much cheaper in terms of fees and always trade at NAV. After a little over a month of trading, the Bitcoin ETFs have collectively acquired more than 700,000 BTC.

heyapollo.com

The impact of these ETFs is already being felt, and it can’t be understated just how much new demand could flow into these vehicles in the coming cycle. We now have some of the largest, most respected financial institutions educating their clients on the value proposition of Bitcoin to market their ETF products. This dynamic is why $50,000 doesn’t feel all that impressive for long-term investors. They are waiting for Bitcoin’s price to appreciate to a much higher level from here.

Another major difference between now and 2021 is that the halving is still ahead of us, not behind us.

As Bitcoin crossed $50,000 in 2021, we were already more than a year and half behind past the halving. Today, the halving is a couple of months away.

Historically, Bitcoin’s price rallies strongly in the months after a halving.

CoinDesk, Coin Metrics

When Bitcoin was over $50k in 2021, it was already one year after the halving and up +559%.

In 2024, Bitcoin is over $50k and has strong momentum going into the halving event, up +112% in the last 12 months.

Looking at only the last two halvings, Bitcoin’s average gain post-halving is +421%. Although past performance does not guarantee future returns, if this trend continues, we could see Bitcoin rallying strongly in the second half of this year. This is just another example of how the Bitcoin setup today is nothing like it was in 2021.

Oftentimes, Bitcoin is described as a “liquidity sponge” because of how sensitive Bitcoin is to liquidity conditions.

Bitcoin typically performs very well when banks are lending, the Federal Reserve is easing, and the government is spending.

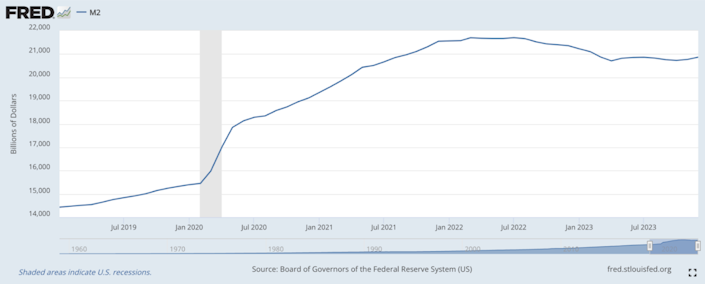

This was never more true than in 2020 and 2021, when the government and Fed collectively inflated the M2 money supply by around $6 trillion.

FRED Data

It’s no surprise that Bitcoin then went on a bull run to $69,000. But around the point that Bitcoin surpassed $50,000 back then, the macro environment was very different.

CPI inflation was at the highest levels in 30 years, and the Federal Reserve was getting worried. Around this time, it began signaling to the market that it would begin raising interest rates in the near future.

We know what happened: The Fed raised interest rates at the fastest pace in history. As a result, all asset prices suffered immensely in 2022, including Bitcoin.

In 2024, things could not be more opposite. CPI inflation has been in a downtrend all of 2023, and instead of the Fed signaling that it will raise rates, it is signaling that it will cut rates in the coming year.

If the Fed does cut rates three times, like the market is expecting, that would provide a tailwind for the price of Bitcoin. Any form of policy easing leads to positive changes in liquidity, which Bitcoin is very sensitive to.

To put it in simple terms:

Dovish Fed = Good for Bitcoin

Hawkish Fed = Bad for Bitcoin

Whereas hawkish Fed policy proved to be a headwind for $50k Bitcoin in 2021, a shift to more dovish Fed policy could be a tailwind for $50k Bitcoin in 2024, helping drive it to new heights.

Up until this point, we have discussed how this run-up to $50k is different because it has primarily been driven by long-term holders, a market infrastructure composed of new and improved players, new investment vehicles that make it easier to gain exposure to Bitcoin, and an expected Fed pivot that will help, not hurt, Bitcoin.

But one thing we haven’t discussed is Bitcoin’s fundamentals, which have only gotten stronger since 2021. The Bitcoin Network has never been more secure, and its adoption continues to grow. Let’s take a look…

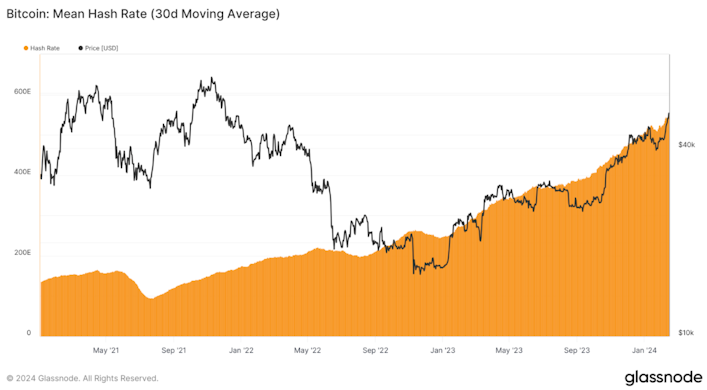

Since 2021, Bitcoin’s hash rate is up 5x.

Glassnode

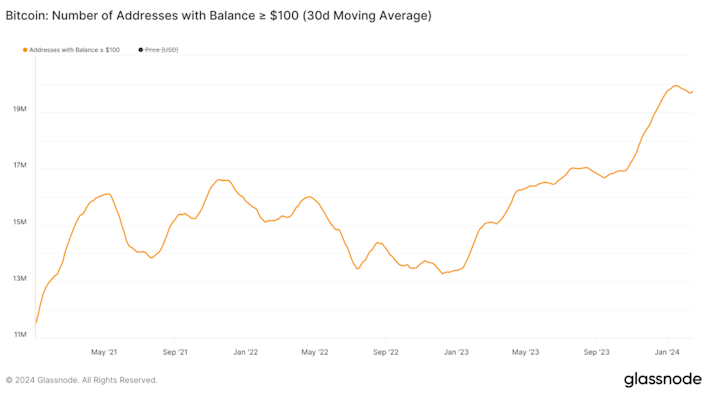

Since 2021, the number of addresses holding >$100 has nearly doubled.

Glassnode

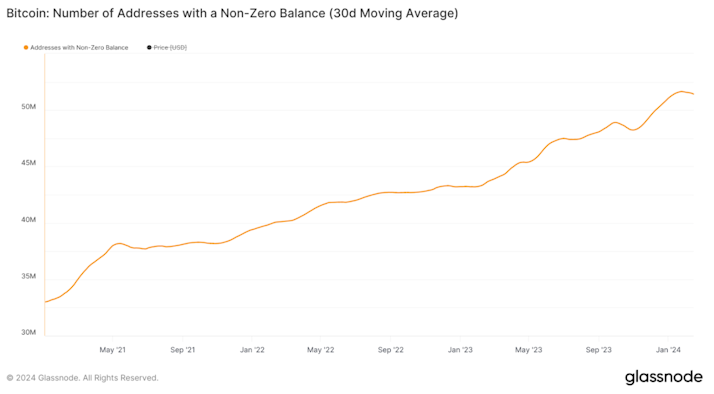

Since 2021, addresses with a non-zero Bitcoin balance have also increased by almost 20 million.

Glassnode

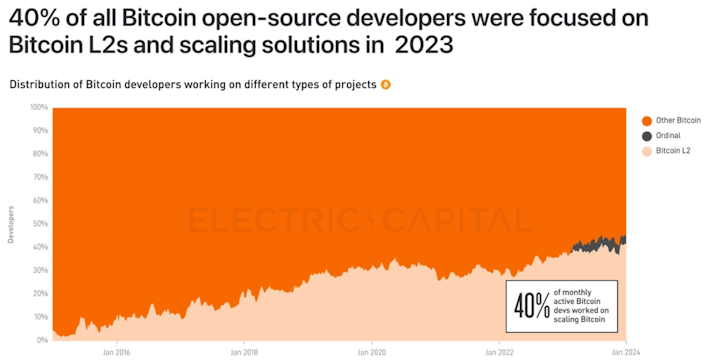

Things look good when it comes to innovating on Bitcoin, as well. Recent data from Electric Capital showed that 40% of Bitcoin development is now focused on Layer-2s and scaling solutions.

Electric Capital

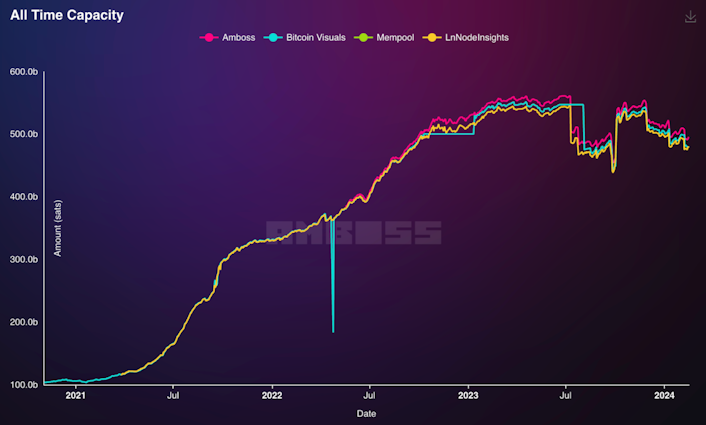

This is clearly evident when looking at the growth of Bitcoin’s most successful Layer-2 scaling solution to date, the Lightning Network. Since 2021, the total amount of Bitcoin locked in the Lightning Network is up more than 400%.

Anecdotally, it’s not difficult to see how Bitcoin’s adoption has leveled up in 2024 compared to 2021. Bitcoin is now being discussed by presidential candidates, on the Congress floor, and is a daily topic on national televised finance shows. You can’t go a single day without reading a Bitcoin-related article in the mainstream media. Almost everyone has heard of Bitcoin, and many appear to better understand that this thing is not going away and is much more than just another “tulip bubble.”

My personal favorite example was when The Economist called Bitcoin the “cockroach of money.”

Indeed, Bitcoin is proving to be very difficult to kill, and the longer it stays around, the more people will begin to learn about it and the more its adoption will grow.

Compared to 2021, the Bitcoin network and ecosystem are stronger and more robust than ever before. The industry has now had 3 more years to deploy hash rate, innovate, and build products that make Bitcoin more convenient and useful for the end-consumer.

I hope these points illustrate how different the Bitcoin setup is today compared to the last time it crossed $50,000.

Instead of being at the end of a bull cycle, we are exiting the longest bear market in Bitcoin’s history. During the bear market, many companies went bankrupt and scammers were exposed. Today, the Bitcoin industry emerges purged of all of those bad actors, and it appears ready to blast off to new all-time highs.

In stark contrast to 2021, this Bitcoin rally has a halving ahead of it, potential Fed cuts on the horizon, little to no new retail involvement yet, better investment options available for investors, and big institutions coming into play.

Although $50k was close to the cycle high in 2021, the current environment makes it easy to believe that this time, $50k marks the beginning, not the end, of an extraordinary bull run. Strap in — 2024 is primed to be a wild ride.

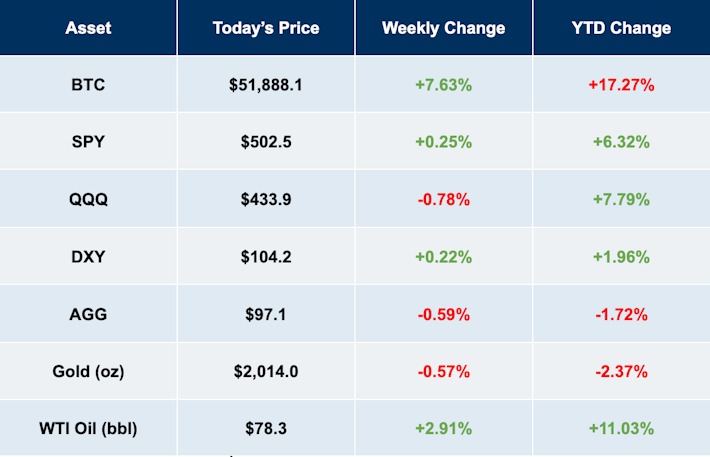

Market Overview

Tradingview, Prices as of 02/16/24

Sign up to start saving Bitcoin

Buy automatically every day, week, or month, starting with as little as $10.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?