5 Reasons to Be Bullish Heading into 2024

While past performance is not a guaranteed indicator of future results, the combination of these catalysts suggests a heightened interest and investment in Bitcoin and another green candle year!

Swan Private Insight Update #31

This report was originally sent to Swan Private clients on January 15th, 2024. Swan Private guides corporations and high net worth individuals globally toward building generational wealth with Bitcoin.

Benefits of Swan Private include:

- Dedicated account rep accessible by text, email, and phone

- Timely market updates (like this one)

- Exclusive monthly research report (Insight) with contributors like Lyn Alden

- Invitation-only live sessions with industry experts (webinars and in-person events)

- Hold Bitcoin directly in your Traditional or Roth IRA

- Access to Swan’s trusted Bitcoin experts for Q&A

2023 ended a stellar year for Bitcoin. Bitcoin ended the year up more than 155%.

The nominal returns do not even capture how impressive Bitcoin’s performance was. On a risk-adjusted basis, Bitcoin was the third-best-performing asset that investors could have allocated their capital to last year.

Only two tech stocks — Meta and NVIDIA — have better risk-adjusted returns than Bitcoin.

Galaxy Digital, Bloomberg

Despite this price run in 2023, it feels as though the party is just getting started. The momentum behind Bitcoin is palpable, and every day there seems to be a new major institution or legendary investor publicly speaking positively about Bitcoin.

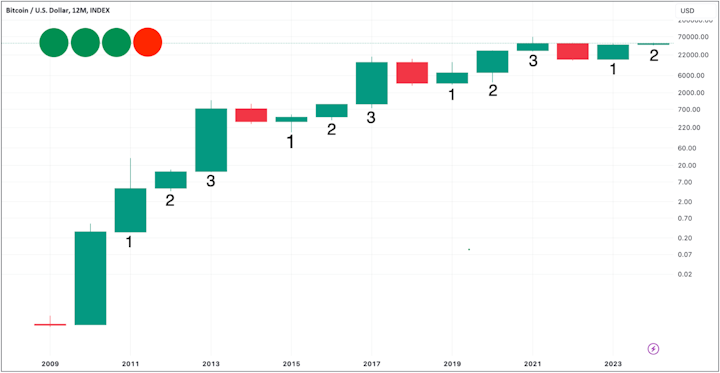

Lately, a new meme has been circulating social media that has some people confused. The meme consists of three green dots and one red dot. An example is shown below.

What the meme is alluding to is Bitcoin’s long-term trend of having 3 up years, followed by 1 down year since 2011. This pattern is clearly visible when you look at the yearly lifetime chart of Bitcoin.

This has many market participants expecting the trend to continue, which means, if history holds true, we just finished the first year of a potential three-year bull run.

It leads to the question, “Is another green dot in store for Bitcoin investors this year?”

Although historical performance is not indicative of future returns, there are several reasons for Bitcoin investors to be optimistic heading into 2024.

In this piece, I will break down five bullish catalysts that have the potential to drive Bitcoin to new heights in 2024 and keep this trend alive.

For anyone focused on developments in the Bitcoin space, this first catalyst comes as no surprise. After nearly ten years of denials, multiple spot Bitcoin ETFs are set to be approved, which will make getting exposure to Bitcoin more accessible than ever before for millions of investors.

Spot Bitcoin ETFs represent a milestone moment for the industry, not only is it a sign of acceptance from the titans of Wall Street and regulators, but they also have the potential to attract tens of billions of dollars in capital flows in the coming year. These flows will drive demand for the underlying Bitcoin and have the potential to impact its price significantly in the coming year and for years to come.

These ETFs will make it so retail investors can get exposure to the price of Bitcoin just as easily as any other stock or bond in their traditional brokerage accounts. But who this impacts the most are many large institutions like pension funds, registered investment advisors, endowment funds, broker-dealers, and banks that are currently restricted from acquiring spot Bitcoin due to regulatory requirements.

These large institutions manage trillions of dollars of wealth. An ETF is a security wrapper that fits into their existing regulatory frameworks. It will allow them to get exposure to the best-performing asset class, and the potential inflows could be huge.

One segment that finds it more challenging to acquire spot Bitcoin on behalf of their clients is financial advisors. Although it is possible today, many are deterred from buying Bitcoin due to regulatory uncertainties with how to legally custody the Bitcoin or because their broker-dealer restricts them from acquiring it. An ETF fixes this.

This was evident in the results of a recent Bitwise survey that asked 437 financial advisors about their thoughts on Bitcoin. Below are some of the key takeaways:

… But the vast majority see its approval as a major catalyst. Eighty-eight percent (88%) of advisors interested in purchasing Bitcoin are waiting until after a spot bitcoin ETF is approved.

Access to crypto is still limited. Only 19% of advisors said they are able to buy crypto in client accounts.

Once you invest, you tend to stay invested (or invest more). Ninety-eight percent (98%) of advisors who currently have an allocation to crypto in client accounts plan to either maintain or increase that exposure in 2024.

Among advisors who allocate, the size of the allocation is rising. Large crypto allocations (more than 3% of a portfolio) more than doubled, from 22% of all client portfolios with crypto exposure in 2022 to 47% in 2023.

Client interest remains strong. Eighty-eight percent (88%) of advisors received a question about crypto from clients last year.

These results show how regulatory restrictions have prevented many financial advisors from allocating to Bitcoin, and that many are waiting for a Spot Bitcoin ETF to do so.

According to data from Cerulli Associates, financial advisors manage around $30 trillion on behalf of retail investors. If only 1% of the $30 trillion that financial advisors manage were allocated to these ETFs, that would mean $300 billion would flow into the asset.

The potential inflows into these ETFs go way beyond just financial advisors too. International bank Standard Chartered recently published its own analysis that concluded that $50 to $100 billion could flow into these Spot Bitcoin ETFs in 2024 alone.

Standard Chartered Research

Although these are just speculative predictions, it’s safe to say that we will see substantial inflows into these products once they are approved, which will be a huge tailwind for the price of Bitcoin moving forward.

With firms like BlackRock, Fidelity, Franklin Tempelton, and Invesco now marketing their Bitcoin ETFs, we will now have the largest, most trusted firms in the world spending millions of dollars to market the benefits of owning Bitcoin in a portfolio.

It’s important to note that the ETFs have several disadvantages to owning real Bitcoin. For starters, there is no annual fee when you take self-custody of Bitcoin. Secondly, when you own real Bitcoin, you remove all counterparty risk and don’t have to trust a third party to secure it on your behalf. Thirdly, Bitcoin trades 24/7/365, unlike traditional securities. And lastly, owning spot Bitcoin offers tax benefits such as less prohibitive tax lost harvesting compared to securities like ETFs.

The hope is that the ETF will act as a top-of-funnel and get more people than ever before gaining exposure to it. Once people invest in an ETF, they will begin to learn about what makes Bitcoin special, and then will eventually decide to own the real thing.

This will surely be aided by the marketing campaigns from these large ETF issuers.

There will be winners and losers when it comes to these ETFs. It’s unsure which ones will take significant market share, and which ones will fail. But the real winner here will be Bitcoin itself as these ETFs will likely help drive Bitcoin education and its adoption to new heights.

Another group of capital allocators that have face hurdles to purchasing Bitcoin are CFOs of corporations.

This is in part due to there being no accounting or disclosure rules specifically for Bitcoin. Businesses need to classify it as an “intangible asset, ” which means they have to mark the value of their Bitcoin holdings on their balance sheets when it goes down, but they can’t record the value when the value goes back up. This creates a huge balance sheet impairment for these companies if the price of bitcoin drops. It creates a situation where a company has to potentially mark its Bitcoin on its balance sheet at a lower value than the market price when it is simply holding it as a treasury reserve asset.

But that all changed in 2024. FASB has officially approved new rule changes that will apply fair accounting rules for Bitcoin beginning in December 2024. This fixes this impairment problem and will allow businesses to recognize losses and gains on their Bitcoin positions and treat Bitcoin just like any other financial asset on their balance sheet.

This accounting upgrade will help the adoption of Bitcoin as a treasury reserve asset at the corporate level. It may sound boring, but this represents a large step forward to dropping the barrier of entry for corporations that want to allocate of portion of their treasuries to Bitcoin.

CEO of Lightspark and former PayPal President David Marcus commented on the significance of this news:

We have already seen corporate adoption of Bitcoin grow, albeit at a slower pace than many expected after MicroStrategy announced its Bitcoin strategy in 2020.

This is the list of known corporations that held Bitcoin in 2020.

Bitcointreasuries.net

Since 2020, the number of corporations on this list has nearly increased fivefold. Despite restrictive accounting rules, some corporations have chosen to allocate to Bitcoin anyway.

US corporate cash is currently sitting near all-time highs at almost $4 trillion, well above historic averages.

FRED, Anthony Carfang

Now that more favorable accounting rules are set to go into effect for Bitcoin, these corporations will find it easier to allocate some of this cash into a store of value that protects their treasuries from inflation and currency debasement.

As Michael Saylor frequently says, today, cash is a liability: a melting ice cube. If only a small percentage of these trillions of dollars in corporate cash flow into Bitcoin this year, this could lead to just another wave of demand that could send Bitcoin’s price higher.

Even more inflationary policies might come sooner than many expected. Throughout 2022, asset prices suffered as the Federal Reserve went on one of the fastest hiking cycles in its history.

At the same time, the government continued on its spending spree. It has run massive trillion- dollar deficits over the last couple of years which have come into conflict with the Fed’s goals to bring inflation as it raised rates. By the CBO’s own projections, these deficits are only projected to grow in the coming years.

CBO

As the government continues to spend, now the Fed looks like it is ready to take its foot off the brake and stop its rate hikes. In fact, the Fed is now signaling they will cut rates despite CPI inflation still running well above their 2% target.

The market is now expecting the Fed to cut rates six times, or for the Fed funds rate to drop 1.65%.

The Daily Shot

Last week, Dallas Federal Reserve President Lorie Logan gave the first hint that the Fed is beginning to contemplate when to end its quantitative tightening program.

If the Fed does decide to stop shrinking its balance sheet and returns to cutting rates while the government continues to run trillion-dollar deficits, we could see inflation come back with a vengence.

In that environment of stimulative monetary and fiscal policy, liquidity will flow into financial markets and asset prices will run once again. It will be scarce, hard assets that benefit the most, and nothing is more scarce than Bitcoin.

A bear case for Bitcoin has always been sound monetary and fiscal policy. If the government were to suddenly decide to cut spending and implement austerity programs and the Fed were to have a change of heart and decide that it needed to keep rates high, shrink its balance sheet, let asset prices fall, and not intervene in the free market, then that would be a headwind for Bitcoin.

But what we are seeing is the exact opposite. It appears that the government will continue to spend and the Fed will continue to do what it has done for the last several decades, intervene in the market, and blow asset bubbles. In that process, it will be Bitcoin which is a prime beneficiary. 2024 could end up being another year where the Fed and Treasury inadvertently pump Bitcoin’s price with their reckless policies.

Up until this point, everything we’ve discussed has focused on the demand side of the equation. Spot Bitcoin ETFs, new FASB rules, and more accommodative monetary and fiscal policy can all help increase demand for Bitcoin over the next year.

But there are also factors on the supply side of Bitcoin that could positively impact Bitcoin’s price over the next 12 months.

Simply put, Bitcoin investors are not moving their Bitcoin. Evidence of this can be observed on-chain.

Today, 70% of the circulating supply has not moved in at least one year. This is near an all- time high.

Glassnode

Furthermore, a record 43% of the circulating supply hasn’t moved in at least 3 years.

Glassnode

With so much of the circulating supply being held by holders who are not moving their coins, it leads to the question, how much bitcoin is currently available for these potential new sources of demand?

Today, there are 2.3 million BTC being held on all exchanges.

Glassnode

This data shows just how scarce Bitcoin is. With large institutions now likely set to start allocating tens of billions of dollars to the asset, they will likely find it difficult to acquire Bitcoin without driving the price up given the small amount of Bitcoin available to purchase today.

In the end, it will likely take much higher prices for these long-term Bitcoin holders to part with their precious bitcoin, and perhaps this dynamic is exactly what we are about to see unfold in the year to come.

2024 marks a very special year in Bitcoin because the fourth Bitcoin halving will take place — a quadrennial event where the supply of newly-issued Bitcoins gets cut in half.

NakamotoPortfolio.com

Here is a quick recap of Bitcoin’s halving schedule:

In April, Bitcoin’s block reward will be cut from 6.25 to 3.125 BTC. This translates to the amount of Bitcoin mined per day dropping from 900/day to 450/day. Historically, Bitcoin’s price has rallied both before a halving and afterward.

Below is a chart that highlights the percentage change by the day leading up to the last three halvings.

Fidelity, Coin Metrics

Only the 2020 halving saw a decline leading up to the halving event, and this was caused by the pandemic crash where all asset classes fell simultaneously.

I expect the price to front-run the halving once again this year because more investors than ever before are familiar with the halving. It will become a frequently discussed topic on television and mainstream media and will drive more attention to Bitcoin. I think the narrative around the halving will impact Bitcoin’s price far more than the actual halving.

The reason why some people argue that the halving impacts Bitcoin’s scarcity is it reduces the amount of Bitcoin being added into the circulating supply. The impact of this may have been more true in Bitcoin’s early days when a smaller amount of the total Bitcoin had been mined, but at this next halving, over 95% of the Bitcoin will have already been mined. Said differently, the proportion of new supply in relation to the existing supply has diminished from one halving to the subsequent one.

Many miners tend to sell at least a percentage of the Bitcoin they mine in order to hedge their business risk and pay for their operational costs. More miners used to hold a significant portion of the bitcoin they mined, but they learned a hard lesson in treasury reserve management when the bear market came around. Today, more miners sell a portion of the Bitcoin they mine and thus represent a price-insensitive seller in the market.

Let’s assume that miners sell 100% of the Bitcoin they mine per day. This would equate to, at today’s prices, about $40 million in selling pressure each day. When that number gets cut in half, that will equate to about $20 million in selling pressure each day. Given that Bitcoin’s daily trading volume is in the tens of billions today, the market will surely be able to absorb that selling pressure without much difficulty.

Nonetheless, Bitcoin’s price historically has rallied significantly after halving events.

Below is a chart that highlights how Bitcoin rallies the year before a halving event (yellow) and the year after a halving event (purple).

Coindesk, Coinmetrics

While correlation is not causation, past halvings show that this rare event is often associated with positive price movements in Bitcoin, but this could be more of a coincidence. We also have to consider investor sentiment, liquidity conditions, and other broader macroeconomic factors that could have influenced the price.

The more nuanced reason for why the halving is so bullish for Bitcoin is it acts as a cleansing mechanism in the Bitcoin mining industry. Every four years, miner profitability gets cut in half with the halving. Because of this, only the most efficient mining operations, run by the best management teams with the cheapest sources of energy, survive. The halving can be thought of as a Darwinian “survival of the fittest” for the mining industry.

This can be observed by looking at the last halving event. Immediately after the block reward was cut in half, unprofitable miners shut down their operations and the hash rate fell 25%.

Glassnode

Eventually, the hash rate recovered as more efficient miners plugged in and took market share. This strengthens the security and efficiency of the Bitcoin network for the long term.

As we look ahead into 2024, the future of Bitcoin appears bright. The confluence of factors outlined in this piece — ranging from the approval of Spot Bitcoin ETFs, the updates in Bitcoin accounting rules by FASB, to the anticipated effects of the Federal Reserve’s policy changes, and the growing scarcity of circulating bitcoin due to holders’ reluctance to sell, and, finally, the halving event — paints a picture of an asset class poised for significant growth.

While the past performance of Bitcoin is not a guaranteed indicator of future results, the combination of these catalysts suggests a heightened interest and investment in Bitcoin and increases the probability that we will see the “three green, one red” trend continue this year. These catalysts, coupled with the evolving understanding and acceptance of Bitcoin as a legitimate and valuable asset, could very well drive Bitcoin to unprecedented levels in 2024.

Swan IRA — Real Bitcoin, No Taxes*

Hold your IRA with the most trusted name in Bitcoin.

Sam Callahan is the Lead Analyst at Swan Bitcoin. He graduated from Indiana University with degrees in Biology and Physics before turning his attention towards the markets. He writes the popular “Running the Numbers” section in the monthly Swan Private Insight Report. Sam’s analysis is frequently shared across social media, and he’s been a guest on popular podcasts such as The Investor’s Podcast and the Stephan Livera Podcast.

More from Swan Signal Blog

Thoughts on Bitcoin from the Swan team and friends.

MSTR vs. GBTC Compared: Which is Best in 2024?

By Drew

This article compares MSTR and GBTC, offering insights for investors by examining their features, benefits, performance, fees, and drawbacks, focusing on their role in Bitcoin investment strategies.

Changing Bitcoin: The Past, The Present, and The Future (Part One)

By Tomer Strolight

For Bitcoin to achieve the lofty goals many have for it, its rules will need to change. This three-part series of articles will tackle what it takes to change Bitcoin.

4 Reasons to Avoid Coinbase In 2024?

By Matt Ruby

The crypto platform is facing all kinds of problems. Is it time for customers to seek out an alternative?